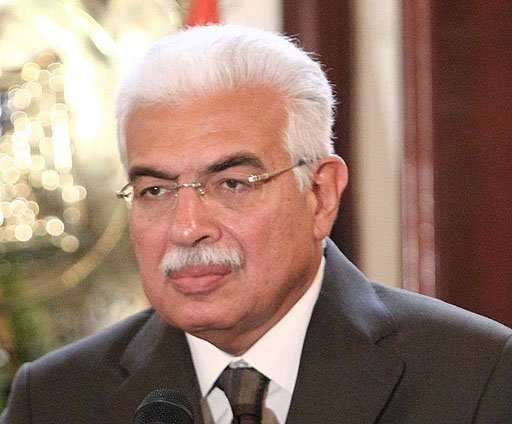

“Our strategy is based clearly on growth through investment, said Nazif.

Nazif’s government worked in its first year to gain investor confidence by improving the investment environment. “Egypt has had a reputation of being bureaucratic, said Nazif. “Today, I believe this image changed.

That sentiment was echoed by comments from the business community.Former President of the American Chamber of Commerce in Egypt and Mansour Group Chairman, Mohammed Mansour, said that a dramatic change has occurred since the new government took over, adding that “investors see Egypt today as a different player.

The government’s target for economic growth is 6 percent per annum for the next 10 years. Gross domestic product grew by 5 percent in real terms during the first quarter of this fiscal year, fueled in part by a tripling of foreign direct investment in non-petroleum industries.

In terms of sources of foreign investment, the government plans to specifically target India and China, in addition to the Gulf, the United States and Europe.

The United Kingdom,in particular, is the largest non-Arab investor in Egypt, with significant investment in the oil and gas sector. It was represented at the conference by Prince Andrew, the Duke of York.

Andrew said that while historically some British businesses were hesitant to invest in Egypt, that has changed with the government’s policy of reducing tariffs, simplifying taxes and strengthening the banking sector. “The most important message that I will take with me back to the U.K. will be that Egypt is open for business.

With regard to the U.S., the possibility of a free trade agreement (FTA) has been discussed by the Egyptian and U.S. governments for several years. Nazif anticipates that the U.S. will take steps before the end of this year to start a process which will eventually lead to negotiations of an FTA with Egypt.

Mohieddin highlighted the significant privatization that has occurred over the past year. Government proceeds from the sale of state-owned enterprises-excluding Telecom Egypt and the Bank of Alexandria-is expected to reach LE 10 billion this year, compared to LE 5.3 billion last year.

Further major privatization is expected in the future, including the sale of government stakes in Misr Hotels, Misr Aluminium and several petrochemical companies.

There was general agreement that the availability of domestic labor plays a critical role in the attraction of foreign investment in Egypt. “I believe this is one of the main assets of Egypt, said Mansour. “We don’t have to import labor.

Despite investor enthusiasm for the government’s economic policy, there is widespread concern about the impact of the Muslim Brotherhood’s gain in the parliamentary elections on the ability of the government to effectively execute its economic policies. Nazif lulled these concerns, saying that “the people of Egypt have given a clear mandate to the president to pursue the [economic and political] reform program . Whether [by] this government or any government appointed by the president. “I’m sure that President Mubarak’s main concern will be to deliver on his promises to the Egyptian people on the reform program, Nazif continued, “irrespective of what the parliamentary election results would be.

Mohieddin focused on the positive aspects of the parliamentary elections results, explaining that the existence of a significant opposition in parliament will be a good test for the government and will prevent complacency in the ruling party.

Egypt Invest 2005 continues today with discussions on financial sector challenges and potential investment opportunities.