Ahli United Bank specializes in making connections. Together with its subsidiaries in Egypt, Qatar, Kuwait, Oman, Iraq and London, the Bahrain-based bank works to ensure that assets move as smoothly from place to place as their owners.

To facilitate the easy movement of funds, the bank launched the MyGlobal program, a system of accounts that gives customers hassle-free access to their money at home and abroad.

Whether it means linking a Kuwait expatriate worker’s account with his family’s assets back home in Egypt, or making sure traveling Qatari customers have access to their funds while on vacation in London, MyGlobal helps to reduce the cost and inconvenience of cross-border banking.

MyGlobal allows customers to benefit from vast range of streamlined banking services, both locally and abroad. Customers can transfer their salary free of charge and enjoy preferential foreign currency exchange rates within Ahli United subsidiaries.

MyGlobal also offers different savings options, a comprehensive statement combining details of all accounts, as well as online and SMS banking services.

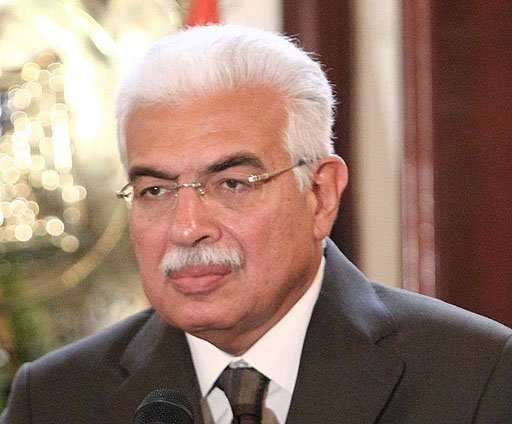

Daily News Egypt sat down with Amr Atallah, Ahli United Bank Egypt’s chief general manager for retail and private banking, to learn more about MyGlobal and other projects in the works at the bank’s Egypt subsidiary.

Daily News Egypt: Why MyGlobal, why now?

Amr Atallah: Our group vision at Ahli United is to be the number one bank in the Gulf, and to best serve our customers we have to take into account the fact that many of them are expatriates or frequent travelers. With this in mind, we developed MyGlobal to accommodate these customers.

During this period of financial crisis we are trying to add value for our clients in any way we can, and that is how the idea came about. We’ve also introduced an array of services to complement the program; we have a MyGlobal credit card, MyGlobal auto loans and a variety of savings schemes tailored for the needs of Egyptian expat workers in the Gulf.

Did the financial crisis impact the implementation of this program in any way?

The bank as a whole intends to expand operations into other countries in the region, particularly Lebanon, Yemen, the UAE and Saudi Arabia, but these plans have been slowed by the onset of the crisis. There has also been a trend of returning expat workers, but this has actually heightened the need for MyGlobal as people transition their finances back to Egypt or to whatever country they are moving to next.

On a general level, Egypt is one of the least impacted countries in the whole banking sector. Our balance sheets here don’t include a lot of outside investments, so banks aren’t strongly impacted by faltering international investment. What really affects us is Egypt’s growth, which continues to be strong. In fact, the bank is up for the first quarter of 2009.

What other services is the bank developing at the moment?

We are in the process of setting up a mortgage finance company. We received our license last month and are in the process of working out the rest of the details. We hope to be up and running by the end of June.

Our mortgage finance plan will be an added value service that helps all of our customers obtain mortgage financing in Egypt and provides them with information about the process and the benefits of mortgage financing.

The mortgage finance market is really expanding right now and we want to take advantage of this trend in the market to offer this service to our customers. There are still some problems with the market – long-term hedging of interest rates is a challenge, but the government and the Central Bank [of Egypt] are working hard to enhance hedging techniques and securitization mechanisms in the market, which should help it mature.

You participated in last month’s Euromoney Housing Finance conference, which focused on the low-income housing finance market. Will the bank move into the lower income housing finance or banking services markets in the near future?

Generally the tendency is for the government to address mortgages and lower income housing, so a small commercial bank like Ahli United is not focused into this segment. At least for the time being we want to focus on properly serving our target customer. Of course, if we find that a new population segment serves our group vision we will make adjustments to accommodate them.

At the moment, however, we are trying to capitalize on our resources and shape our marketing capacity to grow the service. Maybe a couple years down the road we can expand to different population segments.

What does the future of retail banking at Ahli United Bank Egypt look like?

The future of retail is endless, and it’s all about automation; service delivery will key and the more accessibility, the better. All transactions will be through mobiles and the internet, and electronic channels will be enhanced. There is limitless opportunity to expand services through these channels.

I think that in the next two or three years we will see a big change as automation advances, and security evolves along with it. In terms of credit, I believe it will grow as well.

Individual credit lending was risky before i-score, but now Egypt is in a proper position to expand credit safely. What we are witnessing now is that most of the banks are bullish in giving credit to individuals in a disciplined way on a proper standard, and this is a good sign for future expansion of retail services.