CAIRO: The Egyptian Stock Exchange resumed trading on six of 32 stocks it had suspended last week due to what it said were unjustified price increases, according to local news reports.

The remaining stocks will be suspended until the companies outline their strategies for adapting EGX listing regulations.

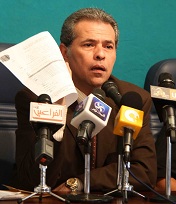

Trading will be resumed once the companies outline their plans to comply with new listing rules and prepare a share value study conducted by an independent financial advisor, EGX Chairman Maged Shawky said.

After suspending trading on 32 stocks throughout this past week, the EGX on Sunday resumed trading on three stocks and then another three on Monday: TransOceans Tours, Cairo Oils and Soap, National Real Estate Bank for Development, Delta for Printing and Packing, Shorouk for Modern Printing and Packaging as well as Egypt Aluminum.

Mamdouh El-Wally, columnist on economics affair and assistant editor-in-chief of Al-Ahram, said the Exchange decided to resume trading on there stocks quickly “to absorb anger among the companies, even though the reasons they gave were not fully convincing.

El-Wally said the suspension decisions were late in coming, attributing that to “the usual Egyptian bureaucracy. He also said that these companies have no great influence on the market, despite the subsequent decline in the volume of trading.

EGX is currently investigating how some of these companies saw stock prices surge up to 500 percent in the last four months, according to local media reports.

Shawky said the EGX’s decision came after the price increased on these low liquidity shares without there being any events or news from these companies to prompt the surge.

“The EGX aims to protect transparency, clarifying the positions of such companies and their true values to help investors make their own decisions, Shawky noted.

“This step is way too late, Enayat El-Naggar, an independent investment expert, told Daily News Egypt, “people forget that the main aim of the stock market is to create liquidity for companies and instead use it as a gambling tool.

Adel Kamel El-Waly, executive director and head of HC Brokerage’s Asset Management Department, agrees, saying in a workshop last week that trading on such stocks absorbs the market’s liquidly.

The rules should be strictly enforced, El-Naggar said; if one company trades 1 percent as a free float and the rules are to trade 5 percent, it should be suspended immediately.

The unjustified rise in stock prices was based on speculation that a crash will happen sooner or later, said Osama El-Kholy, a mid-capital investor.

As a one result of the decision, Egypt’s benchmark EGX 30 retreated by 5.97 percent last week, a total of 398.03 points.

Suspended stocks

1. Cairo Educational Services2. Arab Aluminum3. Egyptian Contracting (Mokhtar Ibrahim)4. Kafr El Zayat Pesticides5. Suez Canal Automotive Repair and Maintenance6. Nasr Company for Civil Works7. Saudi Egyptian Investment & Finance8. Rakta Paper Manufacturing9. Memphis Pharmaceuticals10. Cairo Oils & Soap11. National Navigation 12. Amoun Pharmaceutical Industries Company 13. Delta for Printing & Packaging14. GMC Group for Industrial Commercial15. Nozha International Hospital16. TransOceans Tours17. Misr Hotels18. Guezira Hotels & Tourism19. National Real Estate Bank for Development20. El Obour Real Estate Investment.21. Alexandria National Company for Financial Investment22. El Kahera El Watania Investment23. National Investment & Reconstruction24. National Housing for Professional Syndicates25. El Arabia for Land Reclamation 26. Pens & Plastic Industries (Sicep)27. Alexandria Cement28. Egyptian Sponge29. El Obour Metallurgical Industries (Galvametal)30. Wadi Kom Ombo Land Reclamation31. Modern Shorouk Printing & Packaging 32. Arab Pharmaceuticals