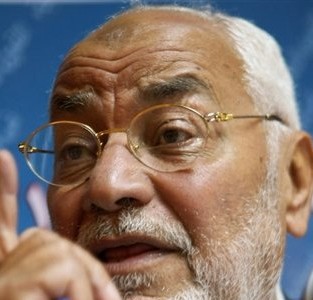

CAIRO: Ziad Bahaa Eldin resigned Sunday from his post as chairman of the Egyptian Financial Supervisory Authority after being tasked to lead efforts to create a national policy that mitigates conflict of interest.

He will be replaced by former deputy Ashraf El-Sharkawy.

Bahaa Eldin told Daily News Egypt that he met with Prime Minister Ahmed Shafiq Sunday morning and was tasked with leading efforts to create a regulatory framework that would mitigate conflict of interest in the public sphere.

“It is one of the most important ways to deal with corruption … most countries have [these policies],” he said, adding that it is an idea he has been proposing for years and something that he has always wanted to work on.

“I have done a lot with the EFSA. Now, I have been instructed to take on this task and will be putting together a team of people to work with,” he said. More important than the policy itself is the process with which it will be implemented, he added.

Asked why it was necessary to resign from his post as EFSA chairman, Bahaa Eldin said it was a demanding job and he is happy to move along in order to devote his time to this new task.

“It should not affect investor confidence or be perceived negatively … the EFSA is a regulatory agency and all the regulations in place will continue to be applied,” he added.

Commenting on the decision to keep Egypt’s stock market closed since Jan. 27, Bahaa Eldin said the best thing to do now is to resume trading as soon as possible no matter what happens.

The stock market will open for trading on Tuesday.

Egypt’s market regulator was formed in June 2009 on the heels of Law 10/2009, which regulates control on non-banking financial markets and instruments, and began operating in July under the chairmanship of Bahaa Eldin, former chairman of the General Authority for Investment (GAFI).

At the time, the new authority brought several regulatory bodies under one umbrella in a bid to invigorate the booming non-banking sector.

The EFSA was tasked with improving market performance and transparency, developing more complicated financial instruments, and overseeing the capital market, the insurance market, mortgage finance and similar non-banking activities.