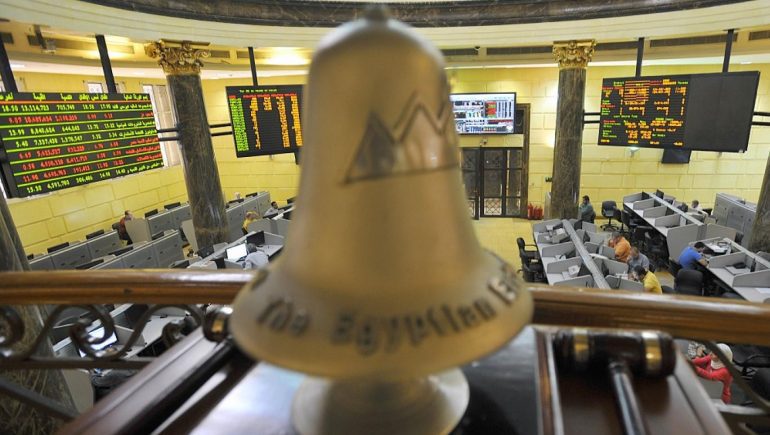

(Photo from IFC)

The International Finance Corporation (IFC) will manage an initiative launched this week by the G20’s Global Partnership on Financial Inclusion (GPFI) platform, which focuses on non-G20 countries and relevant stakeholders. The initiative aims to improve access to financial services for women entrepreneurs and to promote the sharing of knowledge through a new website, Women’s Finance Hub.

The IFC, a member of the World Bank group, launched the website as an online platform to help female entrepreneurs access finance for their businesses by sharing research and information on critical issues related to the women’s market. It will also address gaps in data, promote collaboration in knowledge sharing, and highlight innovation and best practices in expanding women’s access to finance.

“Women-owned enterprises represent significant untapped economic potential,” said Nena Stoiljkovic, the IFC’s vice-president for Business Advisory Services. “It will take much more than credit to unlock that potential. It will also be necessary to expand financial literacy, leverage best practices, and put in place policies and regulations that remove barriers to women’s participation in the economy. The Women’s Finance Hub will provide an important boost to global efforts in these areas.”

According to the IFC, more than 200 million small businesses in emerging markets cannot obtain the credit they need to grow and generate much-needed jobs. The challenge is even more acute for women-owned businesses, which account for more than 30% of these firms. The financing needs of these enterprises reach about $320bn a year, with the main obstacles being access to credit, tools, know-how and business networks.

“We hope that this new collaborative platform will present opportunities for extensive synergies with the IFC’s leading role in the development of the G20 agenda for scaling up access to finance for women-owned SMEs,” said Matt Gamser, head of the Women’s Finance Hub and the SME Finance Forum.

The project, launched during the International Monetary Fund-World Bank spring meetings, was supported by several members of the G20, a group of 20 advanced and developing economies including the US, South Korea, Turkey, Germany, and the UK.