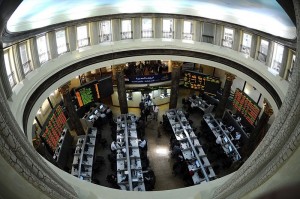

(Photo by Mohamed Omar)

The stock benchmark rose again on Monday after a five-month high recorded the day earlier, following the completion of the Orascom Construction Industries (OCI) deal and a recent interest rate cut by the central bank.

The EGX 30 index closed with a 1.5% surge at 5615.36 points on Tuesday, while the EGX 70 index, encompassing small and medium sized companies, saw a modest rise of 0.53%. The broader index EGX 100 increased by 0.71%.

This rise is a result of positive sentiments caused by the OCI deal, said Ashraf Abdel Aziz, head of institutional sales at the Cairo-based Arabia Online Securities.

OCI was delisted from the stock exchange after its mother-company, OCI NV, the Netherlands-based global nitrogen fertiliser producer, successfully acquired 97.44% of its shares.

Abdel Aziz also attributed the rise to the latest decision of the Central Bank of Egypt to cut interest rates.

On 1 August the central bank lowered its main overnight interest rate by 50 basis points, taking the overnight deposit rate to 9.25% and the overnight lending rate to 10.25%.

Abdel Aziz believed the new head of the stock market has also positively affected stock transactions, especially since the bourse was without a leader for an extended period.

“I expect the coming period to be profit gaining; investors will tend to sell instead, especially with the beginning of a long vacation of Eid El-Fitr, during which clashes may break out and it will consequently affect the stock,” he said.