(DNE photo)

By Abdel Razek Al-Shuwekhi

The National Bank of Egypt (NBE) is aiming to raise its retail banking portfolio during FY 2014/2015 to EGP 35bn compared to EGP 25bn, its target in FY 2013/2014, according to the bank’s head of retail banking Hazem Hegazy.

On the sidelines of a conference workshop on Saturday held in Alexandria, sponsored by the Egyptian Banking Institute (EBI), Hegazy said retail banking is a modern activity that has only entered the banking sector over the past five years, and one which demands greater attention.

NBE had 4 million retail banking customers during FY 2013/2014, and the bank aims to raise that number to 5 million during FY 2014/2015.

NBE’s retail banking portfolio represents around 20% of the total activity on the market, and “the bank is working to increase its portfolio to EGP 35bn in order to raise the bank’s market share,” said Hegazy.

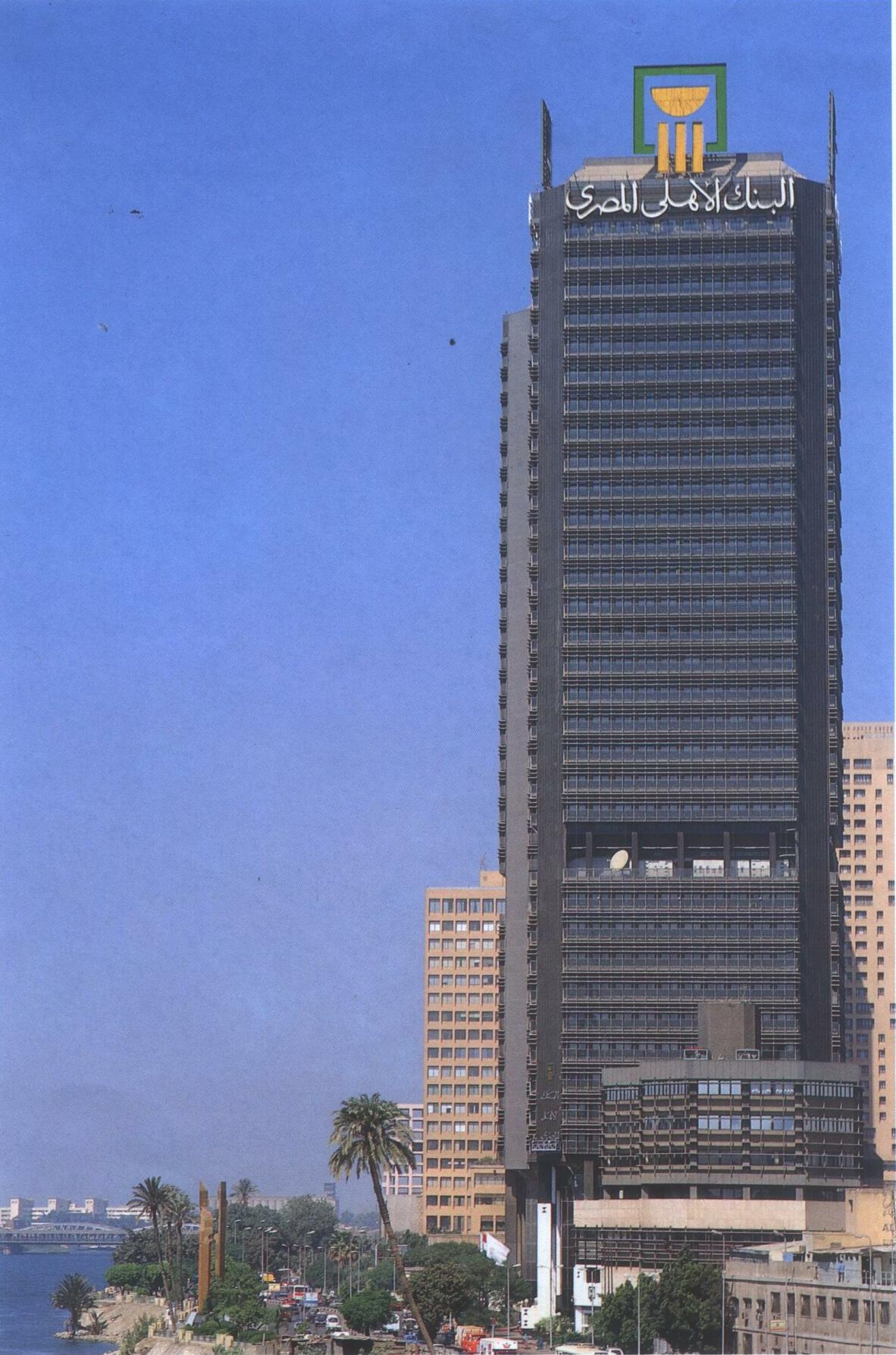

NBE is the largest state-owned bank. It works to stimulate the market, according to Hegazy, who said retail banking is not about credit cards alone, but rather something that pushes economic growth by maintaining employment, increasing living standards and preserving manufacturers, all of which increases gross national product.

The retail banking sector is working on distributing the bank’s risk, but the sector is exhausted, he said, and this is what makes fees high.

According to Hegazy, Egypt is a promising market for retail banking, especially given the state’s desire to stimulate funding for small and medium enterprises.