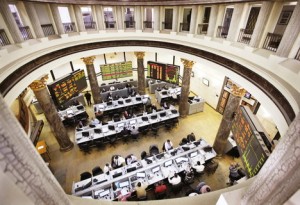

EGX session

The capital market community has strongly criticised the securities tax on the grounds of its being imposed without coordination with them, and that it contains double taxation.

Prime Minister Ibrahim Mehleb, Chairman of the Egyptian Stock Exchange (EGX) Mohamed Omran and head of the Financial Supervisory Authority (FSA) Sherif Sami are currently working together on a solution.

Head of the Tax Authority Mostafa Abd El-Kader said the new tax law includes progressively subjecting the securities portfolios to a 10% to 25% tax. El-Kader’s comments came on the sidelines of a symposium held by the Society of Investment Managers. The proposed increase resulted in a wave of anger amongst the capital market community. El-Kader called on the FSA to discuss the mechanisms to reduce it with the officials of the Ministry of Finance and the IRS.

Former EGX vice president Mohamed Farid said that imposing a tax on the securities portfolio is regarded as a “punishment” on the investor who is seeking to diversify his portfolio. These investments are the base of investment in the stock market.

He confirmed that imposing the tax abruptly without consulting with the capital market community and representatives of the securities industry is “unacceptable.”

“The government will withdraw a tax on capital profits from the Investor who invested in one or more shares individually, and if he want to verify his portfolio with buying more that stock, his portfolio with subject to his income basis of tax so he will pay two taxes on the same basis of tax,” he followed.

According to his statement, the regulations for the Income Tax Law will consider that and will avoid the double taxation and will not punish the investor who seeks to diversify its investment portfolio.

Government sources told Daily News Egypt that the prime minister, the ministries of finance and investment, the chairman of the Egyptian Financial Supervisory Authority (EFSA) and EGX have been holding discussions for two months. The cabinet asked the EGX for a written opinion, while the latter sent one immediately. The recent period witnessed several meetings between Mehleb, chairman of EFSA, and the ministries of investment and finance.

The source said that the delay in issuing the executive regulation of the new tax law may be because subjecting stock portfolios to the general income tax is not yet imposed.

In June 2014, the government had issued a tax on the actual annual capital revenues in the investor’s portfolio in EGX rather than on its value in the market. Any losses the investor goes through will be brought forward to three years.

Chairman of Al-Awael Microfinance Company, Wael Enaba, said: “I don’t believe the government will save what it receives of these taxes because the exchange value will go down following this decision, which will eventually lead to a decline in the number of targeted people. Let us also put into consideration that such decision might lead Arab and foreign investors to invest in cheaper markets that do not impose taxes.”

The Ministry of Finance believes the tax will help the government to increase the spending on items that will improve the efficiency of the services offered to the people and protect the rights of the poor and social justice.

The new tax might drive people away from EGX to the banks, and if this is to happen the banks will not be able to operate the deposit portfolios, according to Mohsen Adel, member of the EGX Council. Adel added that the junior investor will be most affected by the tax in case of imposing it officially.

The average income on money in the banks in Egypt is at 7.5% to 8% and it is not subject to any tax. Any decisions to impose taxes will not please the people, he said.