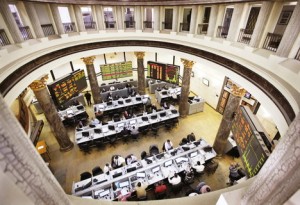

(DNE Photo)

Over 20 companies listed on the Egyptian Stock Exchange (EGX) with over EGP 5bn in capital since May 2014, EGX Chairman Mohamed Omran announced last week.

In an EGX statement, Omran said the “success” of fiscal year (FY) 2014/2015 came after the first summit for the initial public offering (IPOs) that took place in May 2014. This gathered companies and officials to define and analyse the Egyptian companies’ listing in the stock market.

Days before the summit, the first IPO held after the 25 January Revolution was launched by Arabian Cement Company in May, with the company aiming to raise $100m by listing on the EGX.

Edita starts EGX trading in April

Ordinary shares of Egyptian snacks company Edita Food Industries SAE (EFID.CA on the EGX) started trading in early April. In parallel, trading of global depositary receipts (GDRs), each representing five ordinary shares, also began on the London Stock Exchange (LSX).

The start of trading comes after the conclusion of a book-building process, that saw selling shareholders offer 92,483,770 ordinary shares to institutions and a further 16,320,665 shares to retail shareholders in Egypt, according to investment bank EFG Hermes.

The company’s market capitalisation is EGP 6.7bn ($891m), with a free float of 30% between the LSX and the EGX.

On 27 March, Edita announced in a statement the pricing of the institutional offering of 92,483,770 ordinary shares to be listed on the EGX and LSX through the global depositary receipts (GDRs).

The offer price has been set at EGP 18.50 per ordinary share and $12.28 per GDR, thus the company’s market capitalisation is EGP 6.7bn (approximately $891m), according to an Edita statement.

On the second day of trading, the private equity firm that was acquiring 30% of Edita announced it has partially exited from the snacks company by selling a 15% stake as part of the stock offering.

In June 2013, Actis, a global pan-emerging markets private equity firm, invested $102m to acquire a 30% stake of Edita at a rate of $46.8 per share, which has a nominal price of EGP 10. The transaction, which was brokered by HC Securities, reflected Actis’ optimism towards Egypt’s snack food market, despite macroeconomic hurdles which the company is facing, the company said at that time.

SODIC raises near EGP 1bn through bourse

In November 2014, the Sixth of October Development and Investment Company (SODIC) announced that it had raised EGP 993m through a capital increase offered to existing shareholders, from EGP 362.7m to EGP 1.35bn.

The offering had increased the company’s shareholder equity by approximately 47%. SODIC had offered 250m shares at EGP 4 per share during a one month period ending in October 2014, of which 248,233,225 shares were subscribed.

The real estate developer announced in the same period that it is planning to invest $2.3bn in 2015, SODIC CEO Ahmed Badrawi told Daily News Egypt. The investments will be used in the Westown and Eastown developments, as well as in a third project,Villette, covering 301 feddans in New Cairo.

About EGP 1bn of that amount is directly invested into contracting and actual development, and that is across the two main projects: Westown and Eastown. A portion has also been given to Villette. The cash flow for the three projects in the upcoming five years is expected to be EGP 17bn, for the value of sales, plus a percentage from the commercial.

Earlier this year, SODIC agreed to pay EGP 900m to the Egyptian government over seven years after re-evaluating the Eastown project in Cairo.

US-based private equity firm Ripplewood acquired, in May 2014, a nearly 10% stake in SODIC.

GB Auto headed to EGX for capital increase

Leading automotive assembler and distributor Ghabbour Auto (GB Auto) submitted a request to the EGX this year to increase the company’s capital by approximately EGP 960m, through issuing 960m shares at a value of EGP 1 per share.

The capital raise aims to finance the company’s plans to expand its tyre, motorcycle and three wheeler business in Egypt, as well as its regional expansion plans.

Funds from the capital rise would allow the company to build a new two- and three-wheelers plant to allow full CKD assembly. This would “deepen” the group’s presence in the line of tyres, through entering the tyre manufacturing business. It would also allow them to pursue additional regional expansion opportunities in select businesses, the company said in February.

“Political stability in Egypt has made it possible to go to our shareholders and request their endorsement of our plans to capitalise on what we believe are very exciting opportunities in Egypt,” Raouf Ghabbour, Chairman and CEO said at the time.