What happens when a country wants to revitalise its economy through quick cash, directly pumped by investors at the expense of citizens? This was the Egyptian government’s way out from the crunch, to let the people pay, as the Egyptian state coffer is suffering a gap while the population continues to swell.

The Egyptian taxation system, with a sales tax that creates approximately 25.6% of the budget’s revenues, doesn’t differentiate between high-income and low-income people, noted taxes expert Hany El-Husseiny.

“There isn’t social justice in the way taxes are imposed as it doesn’t consider the discrepancies in the population income,” El-Husseiny stressed.

The income tax ceiling in Egypt ends at 22.5%, after a cabinet approval in March, which El-Husseiny said equals between individuals and companies that make millions and billions. This contradicts article 38 of the Egyptian Constitution which instructs the tax system to develop state resources and achieve social justice and economic development

“The government should increase the tranche for highest-income individuals or companies,” he said.

But Head of Tax Authority, Abdel Moneim Mattar, told the Daily News Egypt that the government “depends on sales tax to lure investments and widen its tax base”. He said that sales taxes are paid by the end user for obtaining a product or a service, regardless of the user’s socio-economic background.

However, El-Husseiny noted that the tax ceiling of 22.5%, which is significantly low for companies and businessmen but not the individual, is not the motivation for investments. Investors, however, look for a stable legislative climate and simple procedures to establish their companies and obtain energy.

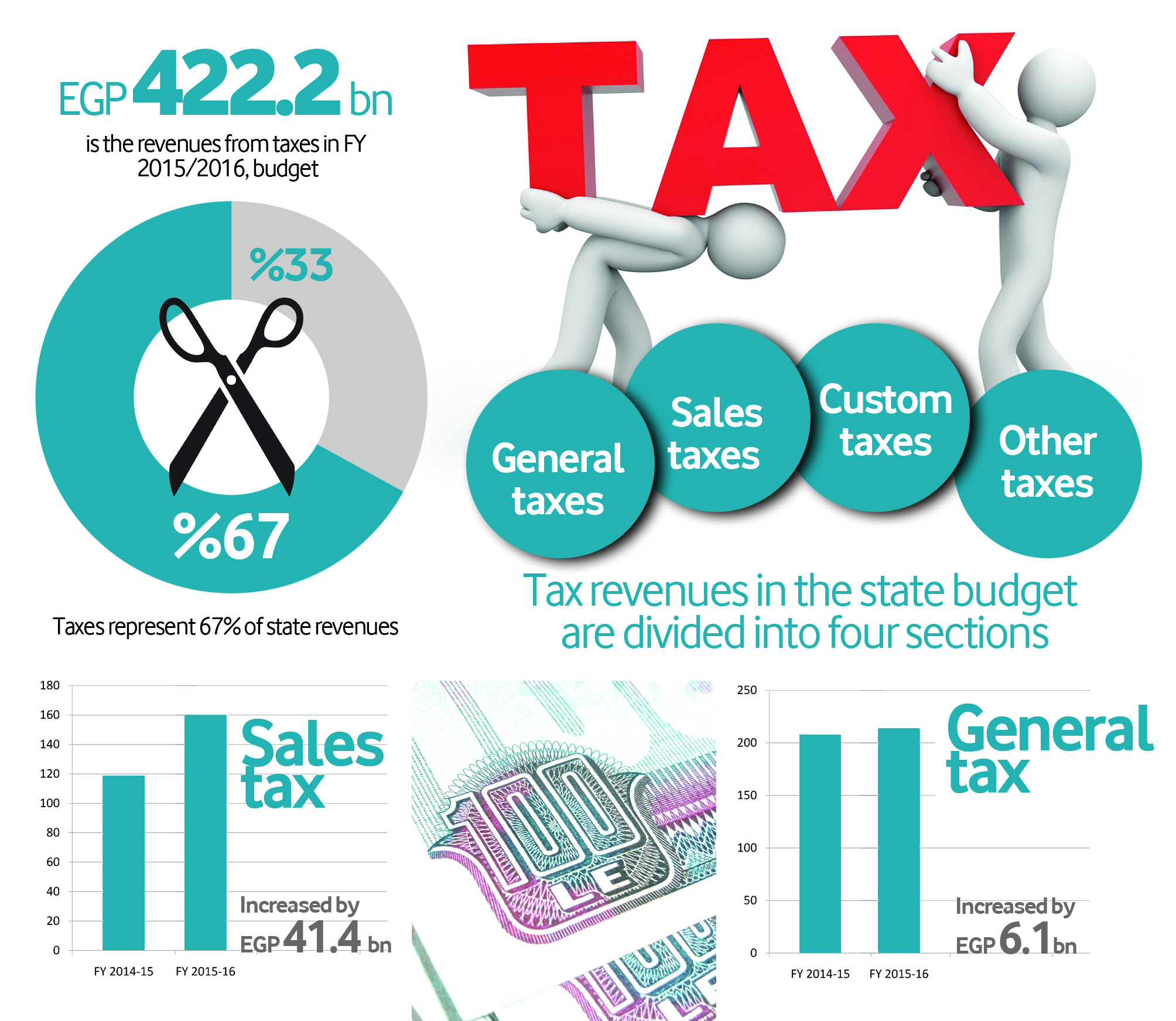

In the current FY 2015/2016, budget revenues from taxes are expected to reach EGP 422.4bn (14.9% of GDP). Revenues from sales taxes in the budget are also expected to increase from EGP 118.4bn in FY 2014/2015 to EGP 159.8bn (5.6% of GDP) this year. Meanwhile, revenues of general taxes are expected to increase from EGP 207.4bn last fiscal year to EGP 213.5bn (7.5% of GDP) in the current fiscal year.

Taxes represent 67% of state revenues

Tax revenues in the state budget are divided into four sections; general taxes, sales taxes, custom taxes and “other taxes”. General taxes are the taxes on salaries, industrial and commercial activities, non-commercial activities, real estate wealth, petroleum activities, the Suez Canal and the Central Bank of Egypt.

Meanwhile, sales taxes are imposed on domestic products, imported products, cigarettes, fuel and petroleum products, telecom services, and tourist hotels and restaurant services.

The estimate of the current fiscal year’s expenditures is EGP 789bn. The budget deficit is expected to register EGP 240bn, which is equivalent to 10% of GDP. According to the current state budget, the general revenues for the new fiscal year’s budget are expected to grow by 28%, amounting to EGP 622.2bn.

The Ministry of Finance plans to increase tax revenues for FY 2015/2016 to EGP 422.4bn, compared to EGP 364.2bn in FY 2014/2015, a growth rate of approximately 13%. The procedures also include completing the value-added tax (VAT) which is currently being partially applied, with the aim of spreading fairness and to resolve the issues in the current system.

But the expected tax revenues seem to be overly optimistic as, according to Mattar, tax revenues over 10 months of the previous FY 2014/2015 amounted to EGP 240bn, out of the expected EGP 364.2bn.

However, the first quarter of the current fiscal year showed some positive vibes. Mattar said the Tax Authority was able to collect more than 95% of the targeted quarterly revenues; EGP 55bn out of the targeted EGP 60bn between July and the end of September.

More resources will further help the government. In October, President Abdel Fattah Al-Sisi issued a decree to increase taxes on flight tickets by 1%. In response to the decree, Mattar said in a televised interview that increasing prices of air transport tickets will increase the budget’s revenues by EGP 330m, adding that hiking prices of transportation services will help reduce the budget deficit.

In the first quarterly report of the Ministry of Finance, released in October, taxes collected aided the government in registering the highest quarterly growth rate of public revenues in the past three years. Public revenues during July and August of FY 2015/2016 increased by 34.5% to record EGP 46.3bn, an increase worth EGP 11.9bn compared to the same period of last FY, according to the report.

The report added that the “economic improvement and reforms” undertaken by the government at the beginning of last FY led to an improvement in income tax revenues, to record EGP 9.4bn.

This comes in addition to EGP 3.4bn in payroll tax revenues, marking an increase of 18%, as well as EGP 800m in taxes from commercial and industrial activity, with a growth rate of 87.7%. Sales tax revenues also rose to EGP 19.2bn, with a growth rate of 34.2%, the highest growth rate in sales taxes during the mentioned two months and over the past three years, according to the report.

Property tax revenues rose by 37.2% to record EGP 4bn. Furthermore, taxes on goods and services rose by 50% to record EGP 2.6bn. This was due to the increase of tax collection from private equity funds by 39.5% to record EGP 1.7bn.

Taxes on stock market trading delayed after pressure from businessmen

A 10% tax on capital gains obtained from trading on the Egyptian Stock Market, which was expected to significantly increase tax revenues, was suspended for two years last May. This was decided to maintain domestic market competitiveness, whilst maintaining the 10% tax on dividends.

The tax was originally imposed in July 2014. Before, transactions on the stock exchange were entirely exempted from taxes on capital gains, which include sales of stock by any investor at a price above the purchasing price. Dividends, whether monetary or in bonus shares, were also exempted.

“Brokerage companies were the reason the tax was suspended, as they used their authority to affect the performance of the stock market, which endured losses during the period of the implementation,” El-Husseiny said, adding that the government was forced to halt the tax.

The Egyptian Center for Economic and Social Rights (ECESR) had criticised the move at that time, saying the governments favours the interests of investors and businessmen over those of citizens. It said the Egyptian government faces difficulty in balancing between two objectives – realising social justice and maintaining a healthy and efficient investment climate.

In another move that was seen as unfair, the government suspended the 5% tax on income of more than EGP 1m a year.

Taxes on properties above EGP 2m face vague destiny

When the Property Tax Law became effective in January 2014, after being delayed several times since it was issued in 2008, the government expected it to bring EGP 3bn in revenues. The government announced that the return will have a social aspect, as a quarter of the revenues will be allocated to developed slum areas, and another quarter to improve localities and citizen services.

The tax obliges taxpayers to pay 10% of the total value of their property annually. According to El-Husseiny, the tax is only affects high-income people, “that’s why it is facing difficulties in proper enforcement”.

However, the Tax Authority wasn’t able to collect the targeted revenues after the law was enforced. In a July 2015 statement, an official at the Ministry of Finance expected annual revenues from the tax to not exceed EGP 400m. From July 2014 to May 2015, the Tax Authority was only able to collect EGP 380m from the property tax, which means that high-income citizens avoided paying the due tax, leaving for the government no option but increase its dependence on taxes from ordinary individuals, through the sales tax.

The Property Tax Law was amended in November 2013 to expand the tax-exempt tranche to include industrial and commercial units along with the normal residential tranche. Those who own EGP 100,000 in commercial and industrial units were exempted from paying taxes.

Furthermore, the most recent amendment to the law occurred in August 2014, when President Al-Sisi issued a decree modifying the tax-exempt tranche to include those who own one residential unit worth EGP 2m, while the original law had exempted only those who own more than one residential properties worth EGP 2m in total.

The latest law exempted hotels, clubs, hospitals, medical centres and clinics affiliated to the armed forces from paying taxes. Hospitals, educational institutions and non-profit charities are also exempted from paying taxes, but touristic resorts and hotels are subject to the law.

Furthermore, residential properties with annual rental values less than EGP 24,000 are exempted from paying taxes, along with commercial units with annual rental values less than EGP 1,200.

Taxes on cigarettes brings billions of pounds in revenues to the state

A month after his inauguration, President Abdel Fattah Al-Sisi issued a decree to increase the tax on cigarettes by 50%, the tax on beer by 200%, and the tax on other alcoholic beverages by 150%.

Government revenues from the cigarette tax reached EGP 12.4bn during the last six months of 2014, double the tax on Suez Canal profits, according to the latest Ministry of Finance data.

In February 2015, a ministerial decree from the Ministry of Finance ordered the Tax Authority when collecting sales tax on cigarettes, to collect an amount of 50 piasters. This would be for every 20 cigarettes produced locally and sold in the local market, and would be used towards the health insurance fee.

The additional tax is estimated to provide between EGP 5bn and EGP 5.5bn annually, most of which will be directed to improving healthcare services, according to the finance ministry.

In Egypt, there are approximately 15 million smokers, more than half of them reside in the countryside. The number of smokers is expected to increase to 16 million, according to the Tobacco Traders Association. Currently, smokers buy cigarette packets worth EGP 23, therefore their annual expenditures on cigarettes approximately amounts to EGP 8,395 per smoker.