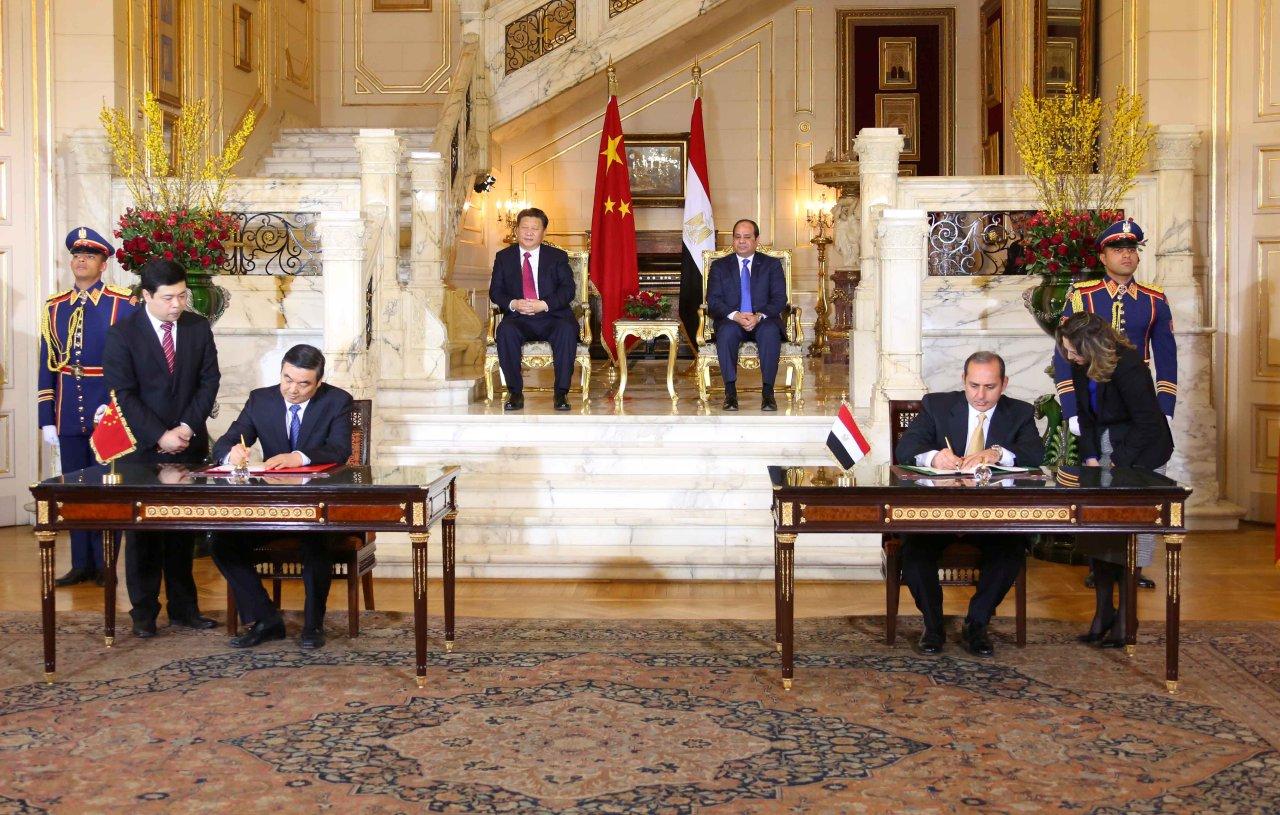

Chairman of the National Bank of Egypt (NBE) Hisham Okasha and Chairman of China Development Bank (CDB) Hu Huaibang signed a loan agreement worth $700m.

The loan targets the implementation of infrastructure projects in Egypt, particularly electricity, energy, telecommunication, transportation, and agriculture projects. The loan will also fund other available projects funded by China.

The signing was attended by Egyptian President Abdel Fattah Al-Sisi, Chinese President Xi Jinping, and Governor of the Central Bank of Egypt (CBE) Tarek Amer.

The agreement reflects the confidence of international financial institutions in NBE’s capability to reinvest facilitations obtained in economic fields targeted by the loan, according to a statement released by the NBE.

According to the terms of the agreement, the loan will be refunded over eight years, with a three-year grace period. After this agreement, the total amount of loans received by NBE from CDB is $1bn. In 2013, NBE signed its first agreement with CDB, which granted NBE $200m to fund infrastructure projects.

In September, CDB granted NBE $100m to fund small and medium projects. In 1999, NBE established a representative office in Shanghai, while in 2008 this office was transformed into an integrated branch, practicing diverse banking business.

This branch was the first Egyptian, Arab, and African bank to be inaugurated in China, which led the bank to play a major role in facilitating commercial and investment cooperation between Egypt, the Middle East, and Africa.

NBE’s branch in China was also able to conduct deals with commercial companies and banking institutions in China. The bank became an essential partner for these Chinese bodies and helped them increase their businesses in the Middle East and Africa.

In light of the achievements realised by the NBE branch in China, which has equity registering at $32m, the bank’s management applied to obtain a license to transact with the Chinese yuan.

It is expected to obtain this licence by the end of 2016, which will lead to an increase in equity to reach $49m. NBE will become the first Egyptian, Arab, and African bank to obtain this licence, which will open up new horizons for broader cooperation between China, Egypt, and all regional countries.

Its presence in China has allowed NBE to reinforce its relations with major Chinese financial institutions, which helped the bank conclude a number of agreements to obtain loans. The bank obtained loans to fund several economic activities, which contribute in supporting the Egyptian economy.

As a member in the Egyptian-Chinese Business Council (ECBC), NBE provides businessmen with necessary advice in order to increase cooperation between Egypt and China.

END