The government’s latest attempts to control the growing budget deficit were causing higher custom tariffs. Citizens are not yet affected from the direct consequences but they know they will pay for it eventually.

The government is applying economic reforms to reduce expenditure and increase revenue due to the EGP 240bn budget deficit in 2016. Expenditures by the end of the current fiscal year (FY) are expected to receive a boost from additional Suez Canal revenues, thanks to the new extension, an increase in tax revenue, and pledged foreign direct investments.

The government aims to reduce expenditures by cutting subsidies and reforming the civil service sector to reduce the wages of public employees.

A new reform has become effective on 1 February through a presidential decree issued in the presence of the legislature. President Abdel Fattah Al-Sisi issued Decree 25/2016 on 31 January 2016 to amend custom tariffs on some imported products to be as following:

- 20% for nuts

- 20-40% for some fruits

- 20% for some sugars

- 40% for dog and cat food

- 40% for cosmetics and perfumes

- 40% for clothes and shoes

- 40% for female personal care products

- 40% for air conditioners and home appliances

- 40% for furniture

According to Magdy Abdel Aziz, the head of the Customs Authority, the new tariffs will increase the government’s budget revenue by $128m (EGP 1.7bn) in second half of FY 2015/2016. While importers will be directly be burdened with increase tariffs, some economic analysts expect the increase costs to be passed on to consumers.

The listed products were picked for its local equivalent use in Egypt and are not essential needs for citizens but rather luxury items. Abdel Aziz said that previous tariffs were set at a value lower than the limits set in agreement with the World Trade Organisation (WTO), “which led to a negative effect on the competitiveness of local products”, according to the decree.

Debate over the effectiveness of the new tariffs

Despite the expected revenue figure minimally increased, the new tariffs did not stop economists and citizens from analysing it due to its potential influential effect on the Egyptian market.

President of Customs Committee in the Federation of Egyptian Industries (FEI) Magd El-Din Al-Manzalawy said the decree will have a limited effect on the market “as the increase is only 10%”. He did not expect higher inflation rates since the increase is not “substantial”.

“Importers can reduce their profit margin to control market prices,” he said.

From his viewpoint, the aim of the decree is to limit imports, increase customs revenue, encourage local production, and increase market competitiveness.

Economic professor at Cairo University Alia Al-Mahdy called this policy contradictory, as a policy that aims to reduce the quantity of imported goods as a protective measure for the domestic market cannot also expect to generate increased tax revenue assuming the same quantity of imported goods.

According to El-Mahdy, the quantity of imported goods will remain constant as long as there is high customer demand. Thus, she expects an augmentation in the price of imported goods as a result of the tariff increase.

“In all cases, prices will increase by approximately 50%,” she said and expects that the prices of other basic products will also be affected.

Al-Mhady said the increase in prices can further increase the inflation rate. The inflation rate was registered at 11.9% in December 2015, slightly higher than the registered 11.8% in November, according to the Central Agency for Public Mobilisation and Statistics (CAPMAS).

Deputy President of Imports Division in the Federation of Egyptian Chambers of Commerce Mohsen Tagoory said that imports will not be harmed by the decree but customers will be. “We will increase prices by the same percentage,” he said.

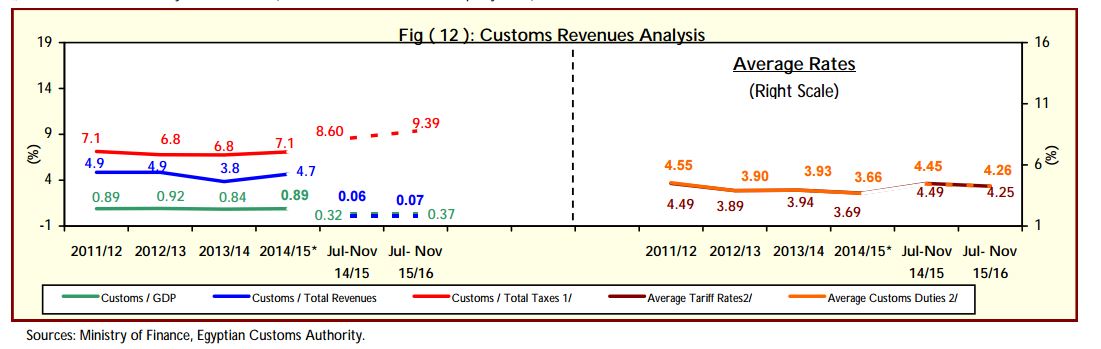

The status of custom revenues in the Egyptian budget

In the first five months in the current fiscal year, Egypt imported products with a total value of EGP 247.5bn, from which the state received EGP 21.6bn in custom revenues.

| Products | Value of imports in FY 2014/2015 | Custom revenues in FY 2014/2015 |

| Total | EGP 455.7bn | EGP 21bn |

| Foodstuffs | EGP 38bn | EGP 245m |

| Primary industrial input | EGP 25.8bn | EGP 159m |

| Fuel and crude oil | EGP 18bn | EGP 288m |

| Durable consumption goods | EGP 6.7bn | EGP 796m |

| Non-durable goods | EGP 20.7bn | EGP 659m |

| Equipment | EGP 50bn | EGP 1bn |

| Goods | EGP 24.3bn | EGP 585m |

The revenue figures seem minor compared to budget revenues. Estimates for the current fiscal year’s expenditures total EGP 789bn while general revenues are expected to grow by 28% to EGP 622.2bn. The budget deficit is expected to be recorded at EGP 240bn, which is equivalent to 10% of GDP.

Customs revenues occupy a marginal place in the budget, contrary to tax revenues, since budget revenues from taxes are expected to reach EGP 422.4bn (14.9% of GDP) in the current FY 2015/2016.

The Ministry of Finance plans to increase tax revenues in the current fiscal year to EGP 422.4bn compared to EGP 364.2bn in FY 2014/2015, a growth rate of approximately 13%.

Most state revenue will come out of the wallets of consumers once the government complete its tax reform procedures that include the application of the value-added tax (VAT) which will be paid directly by consumers. Only a segment of the population currently pays VAT as the government has delayed its broad application in a move it claims will ensure economic fairness.

The state is expected to collect additional revenue, following Al-Sisi’s decree to increase taxes on flight tickets by 1% in October, which Moneim Mattar, head of the Tax Authority Abdel, said will increase budget revenue by EGP 330m.

Despite expectations of drawing more cash into the state budget, the Egyptian government suspended its planned 10% tax on capital gains in trading on the Egyptian Exchange. The decision was taken to maintain domestic market competitiveness, while maintaining the 10% tax on dividends.

Revenues from sales tax in the budget are also expected to increase from EGP 118.4bn in FY 2014/2015 to EGP 159.8bn (5.6% of GDP) this fiscal year. Meanwhile revenues from general taxes, under which fall salary taxes, are expected to increase from EGP 207.4bn in the past fiscal year to EGP 213.5bn (7.5% of GDP) in the current fiscal year.

The expected tax revenues seem to be overly optimistic over the final ten months of the FY 2014/2015, amounting to EGP 240bn out of the expected EGP 364.2bn, according to the Tax Authority.

Will the parliament approve the new decree?

Will the parliament approve the new decree?

The new custom tariffs raised questions over the legislative authority of President Al-Sisi.

According to a human rights lawyer at Alhaqaneya Law Firm, who requested to remain anonymous, Al-Sisi no longer has the broad legislative authority he enjoyed during the absence of parliament. However, he can issue a decree that is supposed to be referred to the parliament for approval. The parliament is required to approve all presidential decrees; however, the new decree is expected to be effective in February pre-empting official approval by the legislature.

Deputy Head of Imports Division Mohsen Tagoory said importers will not request the repeal or the amendment of the new tariffs by the parliament.

Egypt’s new parliament rejected only one among over 300 decrees issued during parliment’s absence when the body convened for the first time in January 2015.

Government Moves to limit imports to ease dollar reserve shortage

The new tariffs were said to control dollar spending on luxury products. Egypt is suffering a severe shortage in dollar currency reserves and has witnessed a continuous decline in the pound’s value against foreign currencies. These factors have significantly increased the imports bill and further burdened the Egyptian pound.

International foreign reserves at the Central Bank of Egypt (CBE) increased by $23m in December at $16.445bn compared to $16.422bn in November. Foreign reserves decreased by $20bn before the revolution. Reserves were recorded at $36bn on the eve of 25 January 2011.

The government aimed to limit “non-essential products” in January and came up with methods to control imports with the aim of “protecting the local industry”. Starting in February, several imports will be banned unless their factories register in the General Organisation for Import and Export Control (GOIC), which is affiliated to the Ministry of Industry.

The list is comprised of 23 categories of products including dairy products, canned fruits, cooking oil, chocolates and products that include cocoa, sugary products, baked products, and fruit juices.

The banned products also encompass cosmetics, soaps, carpets, kitchen tools, tubs, baby diapers, feminine hygiene products, ceramic products, glass tools, armatures, home appliances, home and office furniture, bikes and motorbikes, watches, lightening devices, and toys.

CBE Governor Tarek Amer set new policies regulating the procedure by which importers are provided with foreign currency through domestic banks.

According to the policy, only those imports where foreign financial institutions issue collection documents directly to banks operating in Egypt will be allowed. Collection documents that are provided by the importer to the Egyptian bank will be declined.

The CBE’s instructions also include obliging banks to acquire a 100% cash margin on letters of credit, which encourages funding of commodities for commercial companies or governmental bodies instead of the 50% that was applied before.

It excluded the import of medicines, vaccines and related chemical materials, and baby formula from the cash margin.

The CBE’s stated that the total value of imported products in the previous fiscal year amounted to $60bn. The value of imported fuel and mineral oils products was registered at $10bn compared to $8bn for raw materials, $16.4bn for intermediate goods that serve as inputs in the production of other products, $10.3bn for the means of production, $4.3bn for home appliances, and $9bn for non-durable goods, under which category falls the ready-to-wear clothes sub-category.