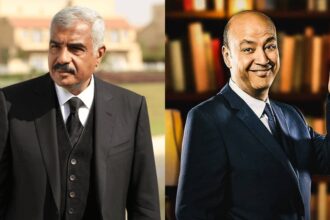

The United Bank of Egypt will soon launch the ‘Egara’ product to finance residential units for low- and medium-income individuals, according to bank Chairperson Ashraf Al-Kady.

During an interview with Daily News Egypt, Al-Kady said that the bank is in the process of completing internal procedures for this product, which will be offered in both regular and Islamic forms.

He added that Egara solves the most important problem facing real estate financing today: the long procedure of registering the units and the high cost of financing.

In the Egara system, residential units are owned by the bank until the final instalment is paid. As a result, the units are not registered before granting them or mortgaging them. This approach, therefore, avoids the complicated registration process, which in turn decreases the cost of financing.

“The bank focuses on real estate financing. We offer that financing to all segments, especially low- and medium-income individuals, because our belief is that this sector significantly contributes to the development of the economy. Egara works on solving one of the most important problems facing citizens, which is affording housing, especially for low- and medium-income individuals,” said Al-Kady.

He explained that the Central Bank of Egypt (CBE) signed an agreement with the Mortgage Finance Fund to finance several residential units in the Suez governorate as part of the initiative to finance low- and medium-income individuals.

Fifty of these units were delivered in the last period, while the remaining units are still being processed/built. In addition, we are looking to obtain and finance other units in New Cairo and Six of October.