Egypt has all the potential to overcome the challenges it has been facing, said Managing Director and CEO of BLOM Bank-Egypt Mohamed Ozalp.

In an interview with Daily News Egypt, Ozalp said that the country has huge potential in tourism, industry, agriculture, energy and mineral resources due to its distinguished geographical location.

However, he pointed out that the inconsistency and slowness in making some decisions over the past years cost the country; “but the quickness of the important decisions made in the last few weeks has been praised by the business community,” he added.

Moreover, he noted that investors’ confidence comes from adopting clear policies along with a vision that does not vary with changing decision-makers, in addition to clear regulatory laws that protect the investor.

He also said that BLOM Bank Lebanon is convinced of the future of Egypt and the importance and necessity of their presence in the country, stressing that the bank’s policy of expansion in the Egyptian market has moved steadily forward over the years.

How do you see the Egyptian economy during the recent period?

Despite the difficult period that we have experienced, I am absolutely convinced that Egypt has all the potential to grow and overcome these challenges.

I say it with pride not because I am an Egyptian, but because I am convinced that no other country in the world has Egypt’s potential and assets that can make its economy grow and attract many investors.

We have great potential in tourism, energy, industry, agriculture, and mineral resources. Moreover, Egypt’s distinguished location is a factor that should mobilise the economy. Egypt lies at the centre of the world, with two seas along its borders: the Red Sea and the Mediterranean. This makes an ideal hub for trade and exports.

Egypt has also signed free trade agreements with the majority of global economic blocs, such as Mercosur, the European Union and the COMESA, which is expected to expand and include all countries in Africa. This is along with other agreements with countries like Russia and Turkey, all of which gives export capabilities a boost.

Furthermore, Egypt has manpower proven to be at the highest level of efficiency, and enabling it achieves high production rates, particularly with proper training.

Many things have improved already, especially in terms of security, infrastructure development, and national projects, but I think we can do much more.

What are the sectors or projects that can help move the Egyptian economy forward quickly?

Firstly, I believe that the major Gas and Oil discoveries made in the last few months will have a major positive impact on the Egyptian economy.

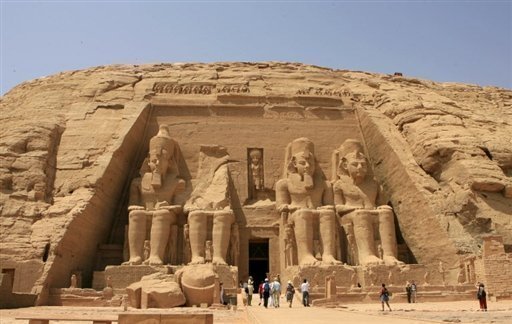

I think that tourism is one of the pillars of the Egyptian economy, considering what Egypt has as natural potential that makes it destined to lead in this field.

Egypt enjoys a temperate climate and has natural and historical museums that highlight the entire history of mankind like no other country in the world. Tourism here does not abide by seasons; we could have tourism in the summer and winter seasons, throughout the year.

The importance of tourism to Egypt can also be seen as being one of the biggest foreign currency generators for the national economy, with revenues that reach the man in the street much quicker than other activities, including industry. The infrastructure of tourism is already there; hence, we do not need large investments to operate it.

Circumstances surrounding us have not helped us to revitalize this important sector, but there are signs and indicators of a soon-to-come change—maybe even as early as October 2016. You can see this in the increase in reservations made in recent weeks.

Agriculture is also vital for Egypt and the growth of its economy. We have large potential in that sector, too. Done right, we could increase our agricultural exports significantly and reach self-sufficiency in many commodities.

There is also industry, through which we can export to African countries or Arab states. The cost of operating in Egypt is much less than in Europe or developed countries.

A number of foreign companies are already invested in Egypt to take advantage of that, and have been very successful.

There are also significant growth opportunities in the energy, infrastructure, real estate, and construction sectors.

What role can small and medium-sized enterprises play in revitalising the economy, and what do they need as support?

There is no doubt that small and medium-sized enterprises (SME) are becoming one of the most important sectors that can fuel the Egyptian economy and drive it forward.

It is known that a very high rate of economic growth in a number of countries, including the United States, Canada, and Europe, comes directly from small and medium enterprises.

In my opinion, many of these enterprises in Egypt need the help and support of banks and the State itself to merge into the formal economy. Another aspect of encouraging the development of SME’s is in their dealing with government agencies such as the reluctance in dealing with tax authorities or regulatory agencies because of the problems it can cause them.

Here, I would like to emphasis that owners of these projects must be treated fairly so they will not be disadvantaged from entering the formal economy.

What can banks do to serve and fund these projects?

I believe that the banks should understand the nature of these projects and be willing to help and finance them.

To achieve this goal, banks have recently begun to establish specialised SMEs departments and have trained their staff to serve this sector.

At BLOM Bank, and even before the Central Bank of Egypt (CBE) launched its initiative to support SMEs, we were already focusing on that sector. These projects currently account for 13% of the total loan portfolio at the bank.

We are confident that we can reach the 20% minimum limit set by the CBE within four years.

In my opinion, if most banks manage to reach this ratio at the end of the four-year period set by the CBE, the impact on the national economy will be extremely positive.

If Egypt has all this potential, why, then, is its economy still ?

Well, stimulating the national economy is not limited to the potential alone.

To illustrate, recent statistics on doing business and investment show that Egypt tails most indicators. Egypt’s image abroad has also been tarnished over the past years for many reasons, including political ones.

Moreover, there has been much conflict and slow movement on some important decisions and measures, even though the most recent weeks saw very positive moves from the government in this regard.

For example the value-added tax (VAT) draft law has been under discussion for more than five years, without a decision being taken.

Basic economics lists speed and decisiveness in decision-making as essential requirements to develop confidence. Furthermore, amendments can be progressively introduced if circumstances change.

The longer decisions are delayed, the heavier the burden becomes on the main in the street.

What were the most important decisions taken by the government to revive the economy?

Well, the business and investment community both locally and abroad has praised the quickness and courage of the decisions taken in the past few weeks. They were of great importance and will have a major impact on the national economy and living standards in the future.

Among those actions were the passage of the Civil Service Law and VAT, as well as the agreement with the International Monetary Fund (IMF), and the government’s decision to issue bonds on international markets to collect $3-5bn.

Moreover, the government is moving to offer shares of state-owned banks’ and companies on the Egyptian Exchange. A Strategic share in a bank will also be put up for sale. All of these measures send a positive message to foreign investors and broaden shareholders base of these institutions. It also confirms reliance in the private sector.

Why can’t ordinary citizens feel the changes happening to the national economy?

It is the case all over the world, not just in Egypt. Price hikes are very disagreable to ordinary citizens and is immediately a burden; however improvement in the economy tales time to impact them.

Unfortunately, there have been many decisions that should have been taken over the last 40 years but were delayed for one reason or another until we reached a point where those decisions became a matter of life or death for the economy.

I am confident that the results of these positive measures recently taken by the government will compensate people for the difficulties they are experiencing in this period.

What is required to move the Egyptian economy forward even faster?

First of all, investment, foreign and domestic, is very important. Therefore, the economy needs an investment-attracting climate. A bridge of confidence between the government and investors, Egyptians, Arabs and foreigners, must be built to encourage them to inject new funds in Egypt.

Confidence comes from adopting a clear policy with a vision that does not vary with each change in decision-makers. Egypt’s economic direction must be transparent and clear and abide by the regulating laws.

Foreign investment, in particular, is very important and vital for the growth of any economy, being not only a main source of foreign currency but also technology transfer and job creation.

What can banks do to support the national Egyptian economy other than investing in debt instruments?

Banks usually invest in Governments T-Bills or Bonds because they have excess liquidity. However their main function is lending which is more profitable and more sustainable. So when there are limited lending opportunities the banks resort to investing in T-Bills and Bonds.

Any competent banker knows that lending is more profitable that just investing in notes.

Treasury bills and bonds for the banks are only an alternative when lending opportunities are not available.

Banks can earn more revenue from credit facilities, which are not limited to loans. Banks can offer clients many other work and personal services, including letters of guarantee, letters of credit, credit cards and retail banking services.

But, unfortunately, there have not been many opportunities for banks. Syndicated loans were even very limited. Investors delayed expansion of their activities and investments in new projects awaiting the improvement of the economy.

Financing trade was also affected due to the shortage in foreign currency.

However it should be pointed out that banks in Egypt have been increasing their loan portfolios significantly in the last two years and we at BLOM have increased our loans by LE 1.6 Billion from August, 2015 to August, 2016.

I believe that the coming period will see quite positive changes as the country’s general situation improves. Banks will then invest less in debt instruments and inject more funds into projects and economic growth.

What are your expectations for the US dollar crisis?

All I can say here is that the return of confidence and encouragement of investments, especially foreign investments, will resolve the problem.

I also believe that the agreement with the International Monetary Fund, alongside the decisions taken by the government to restructure the economy, as well as the recent major oil and gas discoveries will also help alleviate the shortage problem.

What role does BLOM Bank-Egypt play in service of the Egyptian national economy?

We are fully convinced of the bright future ahead for Egypt. We understand the importance of Egypt, not only to the region, but to the entire world, and we are committed to growth and expansion.

BLOM Bank’s expansion strategy has not changed over the years. The mother company believes that the Egyptian market is the bank’s most important market in the Middle East region.

If the mother company was concerned about the future of Egypt, it would have repatriated profits abroad. However, since BLOM entered Egypt, not a single piaster was distributed or repatriated. All the profits were directed to strengthen the financial position of the bank and increase its ability to expand, boosting the bank’s capital to EGP 1.25bn.

We are operating through 33 branches in Egypt and are about to open a new one in Minya soon. Our expansion plan also includes opening six new branches between the last quarter of 2016 and mid-2017.

About 900 employees are now working to serve our clients with a total balance sheet of EGP 21bn, which increased from EGP 7.6bn at the end of 2010.

The bank has a prominent role in the financing of all economic sectors, especially energy, construction, industry, food and agriculture, and medicine.

The bank’s loans portfolio amounted to EGP 7.2bn at the end of June 2016, compared to EGP 3bn at the end of 2010. Meanwhile, deposits registered EGP 18.8bn increasing from EGP 6.1bn at the end of 2010.