The United Bank announced that it would be joining the Egyptian Small and Medium Enterprises (SMEs) Association, becoming the first bank to join the association, in which many individuals and institutions are contributors, including Business Media group.

The bank has participated in the economic saloon, organised by the association last week. The saloon was led by Khaled Nagaty, head of the Egyptian SMEs Association and vice president of World Association for Small and Medium Enterprises (WASME). It was attended by many small and medium entrepreneurs, who shared their problems in dealing with banks, as well as a large number of bankers, economic experts, and media representatives.

Moreover, the saloon also hosted Nevine Kashmiri assistant to the managing director of the department for funding large, and small- and medium-sized enterprises (SMEs)of the United Bank , who spoke about the role of SMEs in the comprehensive economic plan for vision 2030.

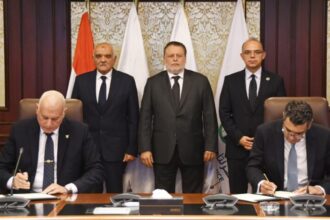

During her speech, Kashmiri announced the approval of the United Bank’s board of directors to join the association. She also noted that the bank is nearing the signing of a cooperation protocol with the association to investigate means of providing technical and financial support to develop the sector.

Additionally, she pointed out that the state bodies, led by the Central Bank of Egypt (CBE), are now working on activating the president’s initiative to provide EGP 200bn to support SMEs in order to create new job opportunities, eliminate unemployment, merge the non-formal economy with the formal economy, and achieve financial inclusion.

She added that SMEs represent a huge segment of the Egyptian economy, with an estimated size of about 80% of all companies in Egypt.

Kashmiri explained that the attractiveness of these projects is the speed of the return on investment for these projects compared to larger projects, due to the simplicity of the technology used, the small size of capital, and its rotation. “They contribute over 50% of the total GDP through different economic activities,” she stressed.

According to Kashmiri, the United Bank is set to, within its strategic policies, heavily enter financing of Micro, Small, and Medium Enterprises (MSMEs), with a clear vision and an integrated programme that aims to serve the sector professionally and follow-up on it accurately to develop the sector, with a focus on commercial, service, and industrial sectors.

She explained that this matter will be implemented through three main axes. The first is to carefully study the market and the nature of clients, relying on the network of 51 bank branches across the republic. This aims to record the sector needs and prioritise them regarding the nature of the projects and its activities, which vary strongly from one province to the other.

She added that the second axis is based on the selection of experts that can manage the MSMEs sector in particular, and the whole banking system in general, with all professionalism.

According to Kashmiri, the third axis is based on the development of specialised and modern technological information systems that serve the nature of these projects in various activities, whether computer programmes or work schemes. This aims to provide maximum safety and follow-up scores, save time, and serve with accuracy, as she put it.

During the saloon, she pointed out that the United Bank has established an incubator and early warning unit to serve the SMEs sector, noting that the unit aims to follow up on an almost daily basis on these project in order to ensure their success and sustainability, as well as to provide all the necessary technical and financial consulting to them, whether traditional banking solutions or Islamic solutions.

Asked about the challenges that hinder opportunities to maximise investments in the SMEs sector, Kashmiri said that it suffers from different social, administrative, and financial challenges, despite the initiatives and facilities provided by the state agencies and civil society.

On the importance of these projects in bringing forth economic transformation for individuals and society as a whole, she added that the low community awareness, especially among young people and women, is at the head of the challenges facing these projects.

She noted that there are also administrative difficulties facing these projects, which the government is trying to overcome. These difficulties, according to Kashmiri, include obtaining necessary permits, due to bureaucracy, lack of data and figures on the sector, and absence of a real guide to the nature of these projects—meaning where they are and how to develop them. She added that this is now being overcome through developing the one-stop shop.

Kashmiri said that the lack of banking and financial awareness for investors in this sector makes them reluctant to seek banks to unlock funding opportunities, which banks and institutions, especially the Egyptian Banking Institute and CBE, are currently solving by organising training and education courses for bankers serving the sector.

As for the United Bank initiative to raise the efficiency of Egyptian products, Kashmiri said that this initiative was launched under the name of “Financing the Start,” to raise production efficiency, improve the quality of Egyptian products, and give a strong push to revive the economy.

Furthermore, she said that the United Bank is keen on providing financing opportunities to SMEs, in cooperation with the Social Fund for Development (SFD), which is the bank’s largest partner in supporting the sector through traditional, as well as Islamic funding. She noted that the bank comes second only after the National Bank of Egypt in cooperation with the SFD.

Also during the saloon, Kashmiri shed light on the global experience in the financing of these projects, especially the experiences of India, China, Japan, Malaysia, and Jordan, stressing that the success of Japan’s economic and industrial breakthrough was based on the integration of major and small industries.

Nagaty said that financing is not a birthright but rather an investment that needs to meet the terms of funding.

He wondered why some banks do not finance many projects. The question was answered by Kashmiri, who said that some banks do not approve granting funding for some projects that cannot prove seriousness and feasibility, noting that there had been cases where clients used to get financing even if the project is not implemented, where loans were used for marriage or buying houses.

In conclusion, Kashmiri urged the media to educate the youth on the importance of these projects to them and to the Egyptian economy as a whole.