The Central Bank of Egypt (CBE) has revealed that the contribution of bank financing to the state budget’s deficit declined during the second quarter (Q2) of 2019, expecting the decline in the annual contribution of foreign financing to continue.

The CBE explained in its monetary policy report that it is intended to achieve an initial budget surplus of 2% of GDP during the fiscal year (FY) 2018/19, while continuing to achieve this surplus thereafter to reduce levels of debt.

It also targets to reduce the overall deficit of the state budget initially to 8.2% and 7.2% of the GDP during FY 2018/19 and 2019/20, respectively.

On the other hand, the CBE explained that trade tensions and the development of world commodity prices, especially oil, are the most important risks surrounding domestic inflation, pointing out that the outlook of local inflation includes measures to control state finance, which included increasing the prices of some petroleum products and electricity.

Furthermore, the CBE revealed the shift of investors’ interest from treasury bills (T-Bills) to bonds (T-Bonds), which is considered a positive change in investors’ macroeconomic view of Egypt.

Furthermore, the CBE revealed the shift of investors’ interest from treasury bills (T-Bills) to bonds (T-Bonds), which is considered a positive change in investors’ macroeconomic view of Egypt.

As trade growth continues to slow down, international oil prices decline and capital continues to flow into emerging markets (EMs).

Economic growth of Egypt’s external environment continued to soften in Q1 of 2019 for the third consecutive quarter, declining to 2.4% from 2.5% in the previous quarter, and from 3.2% in Q4 of 2017, the highest pace since 2011.

However, after easing for four consecutive quarters between Q1 and Q4 of 2018, economic growth in advanced economies inched up slightly to register 1.6% in Q1 of 2019, compared to 1.5% in Q4 of 2018. This was mainly supported by higher growth in the United States, the United Kingdom, and Japan.

Meanwhile, economic growth in the Euro area remained unchanged in Q1 of 2019, compared to the previous quarter. On the other hand, economic growth in emerging economies declined in Q1 of 2019 to 4.1%, compared to 4.9% in Q4 of 2018, after maintaining continuous improvement between Q4 of 2015 and Q2 of 2018.This was mainly supported by slower growth in Russia, India, and Brazil.

Meanwhile, economic growth in China remained unchanged in Q1 of 2019, compared to the previous quarter.

Headline inflation of Egypt’s external environment inched up in April and May 2019 to register an average 2.2%, compared to 2.0% in Q1 of 2019, after declining for two consecutive quarters. Inflation in advanced economies increased in April and May 2019, registering an average 1.6%, compared to 1.5% in Q1 of 2019. Meanwhile, inflation in emerging economies also increased in April and May 2019, registering an average 3.6% up from 3.1% in Q1 of 2019. The acceleration of inflation rate in China, India, and Brazil has more than offset the deceleration of inflation in Russia, compared to the previous quarter.

Annual global trade growth continued to slow down for the sixth consecutive quarter in Q1 of 2019 to register 0.5%, compared to 1.6% in the previous quarter, and down from a peak of 5.2% in Q3 of 2017.

Brent crude oil prices declined in June 2019 for the first month in 2019, registering an average $64.2 per barrel, compared to an average $71.3 per barrel in May 2019. In early July 2019, OPEC and its partners agreed to extend production cuts until March 2020.

International food prices, using domestic consumer price index (CPI) of core food items, continued to decline on annual terms in June 2019 for the twelfth consecutive month. The decline was mainly due to poultry and dairy products, as supply conditions improved.

The Federal Reserve (Fed) kept its policy rate unchanged in June 2019 for the fourth time, after raising it cumulatively by 225 basis points (bps) since December 2015.

The European Central Bank continued to keep its policy rate unchanged in June 2019 after cutting it in March 2016. The Bank of England also kept its policy rate unchanged in June 2019 for the fourth time, after raising it cumulatively by 50 bps since November 2017.

The three central banks maintained the status quo to their asset purchase programmes since the previous monetary policy report.

The three central banks maintained the status quo to their asset purchase programmes since the previous monetary policy report.

Capital inflows into EMs resumed in June 2019 after a brief reversal in May 2019. The return of international capital to EMs in 2019, after eleven months of outflows between February and December 2018, continued to be mainly supported by a tightening monetary policy pause in advanced economies.

However, the direction of capital flows remains subject to the economic activity growth outlook as well as the prospects of further escalation of trade tensions.

The financial account surplus improved in Q1 of 2019, while the current account deficit continued to widen for the second consecutive quarter.

After improving on annual terms for seven consecutive quarters between Q4 of 2016 and Q2 of 2018, the current account deficit continued to widen in Q1 of 2019 for the second consecutive quarter.

This was mainly driven by a less favourable contribution from hydrocarbon and non-hydrocarbon trade deficit as well as net receipts from services, which more than offset the more favourable contribution from remittances as its annual pace of decline eased compared to the previous quarter.

Meanwhile, the deficit of net exports of goods and services widened in Q1 of 2019 on annual terms for the first time since Q4 of 2016. This was due to a less favourable contribution from hydrocarbon and non-hydrocarbon trade deficit, and the service surplus.

Despite the fact that the hydrocarbon trade balance registered an improvement on an annual basis for the fifth consecutive quarter, the pace of the improvement declined in Q1 of 2019 and the balance recorded a deficit after recording a surplus in the previous quarter for the first time since Q4 of 2013.

This was mainly driven by a less favourable contribution from exports and to a lesser extent from imports.

The non-hydrocarbon trade deficit continued to widen on annual terms in Q1 of 2019 for the sixth consecutive quarter.

This was mainly due to a less favourable contribution from exports compared to the previous quarter, while imports continued to increase at a largely stable pace.

The service surplus stabilised in Q1 of 2019 on annual terms, after improving for eight consecutive quarters since Q1 of 2017.

This was mainly due to a less favourable contribution from most net service balances.

This was mainly due to a less favourable contribution from most net service balances.

The financial account surplus improved during Q1 of 2019, after narrowing over the previous three quarters. This was mainly due to Eurobond issuance and portfolio flows in L/C debt, supported by the positive shift of investor sentiment regarding EMs since the beginning of 2019.

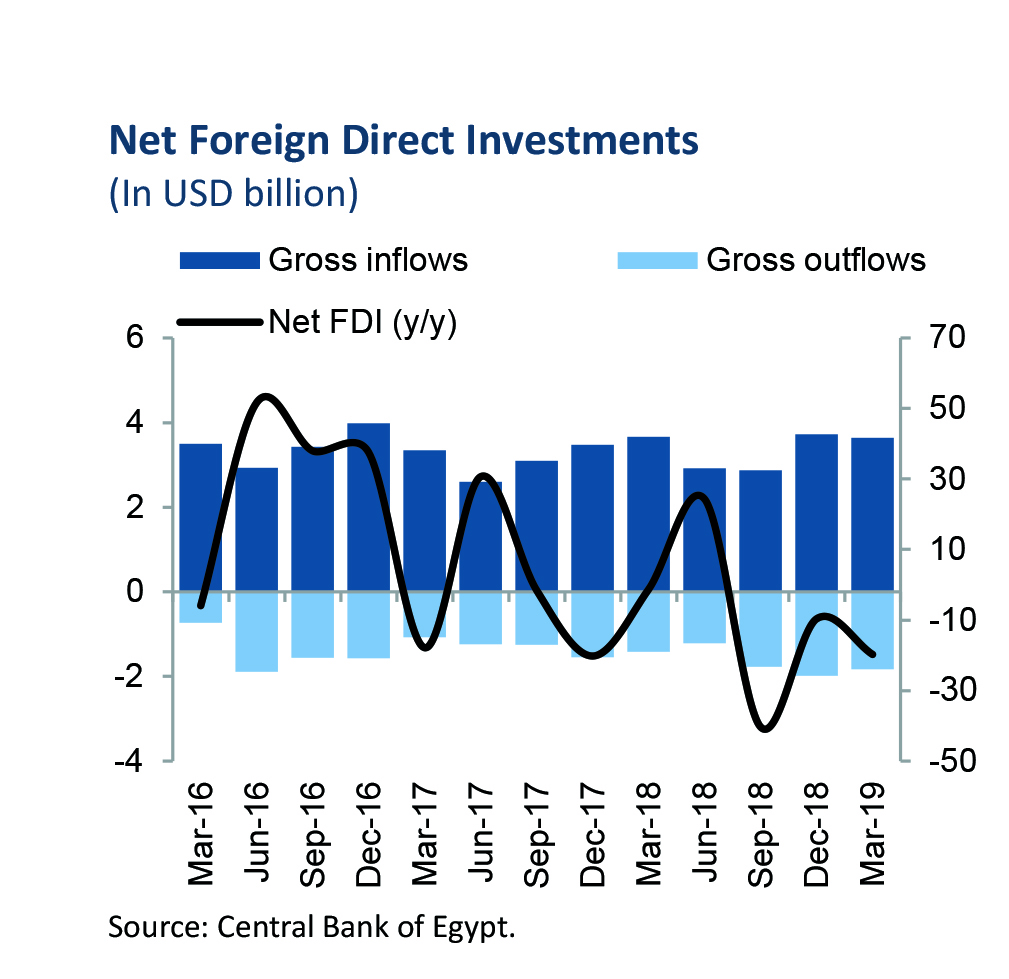

Contemporaneously, net foreign assets of commercial banks improved, after declining between Q2 and Q4 of 2018. On the other hand, net foreign direct investment (FDI) continued its annual decline in Q1 of 2019 for the third consecutive quarter, after witnessing an annual increase in Q2 of 2018 for the first time since Q2 of 2017.

Meanwhile, gross international reserves remained broadly stable in June 2019 for the fourth consecutive month at $44.3bn, after increasing in February 2019.

Real GDP growth continued to increase slightly to record a preliminary estimate of 5.7% in Q2 of 2019 and 5.6% in FY 2018/19, the highest since FY 2007/08. The unemployment rate continued to decline to record 8.1% in Q1 of 2019, compared to 8.9% in the previous quarter.

Real GDP growth continued to recover since Q4 of 2016 and is estimated to have strengthened to 5.7% in Q2 of 2019, resulting in 5.6% for FY 2018/19, the highest since FY 2007/08. The recovery was mainly driven by net exports, while private domestic demand was contained and public domestic demand generally weakened after contributing strongly in FY 2016/17. Domestic demand was rather driven by investments than consumption.

Meanwhile, the unemployment rate continued to drop to record 8.1% in Q1 of 2019, compared to 8.9% in the previous quarter.

The improvement of the contribution of net exports was driven by higher real exports growth and contracting real imports. Nevertheless, since Q1 of 2018, the growth of real exports has been weakening and contracted in Q1 of 2019 for the first time since Q2 of 2016, while the contraction of real imports has been increasing.

Meanwhile, the containment of private domestic demand, especially since Q4 of 2017 was mainly due to weaker consumption, while investment was somewhat supportive, mainly driven by investments in real estate, gas extractions, and more recently electricity.

On the other hand, the contribution of public domestic demand generally weakened since Q2 of 2017 due to weaker investments in national projects, notwithstanding its slight recovery in Q1 of 2019, which was mainly due to investments in healthcare.

At the sectoral level, output growth improved in Q1 of 2019, compared to the previous quarter, on the back of the continued stronger contribution by the public sector, while the contribution of the private sector remained unchanged.

The improvement in the contribution of public sector output since Q4 of 2016 comes mainly due to natural gas extractions and to a lesser extent petroleum processing and the Suez Canal, despite the weakness in general government output between Q4 of 2016 and Q4 of 2018 before strengthening in Q1 of 2019.

The improvement in the contribution of public sector output since Q4 of 2016 comes mainly due to natural gas extractions and to a lesser extent petroleum processing and the Suez Canal, despite the weakness in general government output between Q4 of 2016 and Q4 of 2018 before strengthening in Q1 of 2019.

Meanwhile, the contribution of the private sector output has been weakening since Q3 of 2017 due to a number of activities, notably non-petroleum manufacturing, real estate, trade, tourism, and to a lesser

extent construction, while that of communication has been strengthening since the beginning of 2018.

Activity indicators for the non-hydrocarbon sector somewhat improved in Q2 of 2019. Growth of the manufacturing index continued to recover on average in April and May 2019, after contracting in Q4 of 2018.

The purchasing managers’ indexes (PMI) level strengthened in Q2 of 2019, after it had weakened in Q1 of 2019 and Q4 of 2018.

The growth in the number of tourist nights slightly improved in April 2019, compared to Q1 of 2019.

Meanwhile, Suez Canal net tonnage growth continued to soften since peaking in Q4 of 2017, in line with global trade developments. Additionally, annual total car sales continued to contract since October 2018.

In the hydrocarbon sector, natural gas production continued to increase strongly on annual basis, yet at slower pace during April 2019, compared to the average pace in Q1 of 2019.

Broad money growth stabilised in Q2 of 2019 after recording a six-year low in Q1 of 2019, supported by fiscal consolidation and the containment of other broad money counterpart assets’ growth.

Following the fading of the exchange rate revaluation effect in Q4 of 2017, average annual M2 growth continued to decline to record 11.6% in Q1 of 2019, the weakest pace since Q4 of 2012, and remained around this level in Q2 of 2019.

The decline was supported by fiscal consolidation and the containment of other broad money counterpart assets’ growth.

The decline in M2 growth favourably coincided with an annual increase in broad money velocity that suggests lesser room for non-inflationary money growth. In Q2 of 2019, the negative annual contribution of foreign non-bank financing of the fiscal deficit continued to ease for the second consecutive quarter, in line with the pause of monetary policy tightening in advanced economies.

In Q2 of 2019, the negative annual contribution of foreign non-bank financing of the fiscal deficit continued to ease for the second consecutive quarter, in line with the pause of monetary policy tightening in advanced economies.

This was more than offset by the decline in contribution of bank financing of the fiscal deficit in addition to the expected drop in contribution of external financing, compared to Q1 of 2019.

Meanwhile, the contribution of other broad money counterpart assets increased slightly compared to Q1 of 2019, despite the continued decline in contribution of credit to the non-budget public sector.

This was mainly due to the ease in negative contribution of net foreign assets that are not related to fiscal deficit financing.

Meanwhile, the contribution of claims on the private sector stabilised in Q2 of 2019, following its increase between Q2 of 2018 and Q1 of 2019. Nonetheless, inflation adjusted L/C claims on the private sector continued to witness annual increases since Q1 of 2018, after recording annual contractions in 2017. The recovery was especially evident for claims on the private business sector, while claims on the household sector recovered by a relatively weaker magnitude.

Within the components of M2, CIC as a percent of L/C deposits in M2 increased slightly in Q2 of 2019 following its decline between Q3 of 2018 and Q1 of 2019, however it continued to hover below its long-term historical average, which continued to suggest relative lessening of currency holding behaviour.

Furthermore, the dollarisation ratio defined as F/C deposits to total deposits in M2 continued to decline marginally during Q2 of 2019, while the annual growth in F/C deposits in USD also declined marginally for the second consecutive quarter following its continued increase since mid-2018.

Moreover, the structure of household deposits in L/C continued to be dominated by deposits more than three years since May 2018, following one and a half years of dominance by deposits less than three years amid the introduction of 18-month saving certificates at a higher rate compared to longer term saving certificates.

The reversal of the structure of household deposits is consistent with redemptions of these certificates since May 2018, given their cancellation by public banks in late April 2018.

Annual growth of M0, adjusted by total excess liquidity, continued to decline in Q2 of 2019 for the seventh consecutive quarter due to the CBE balance sheet operations which lowered excess liquidity growth. Meanwhile, the money multiplier, measured as the ratio between local currency components of broad money and M0 as defined above, resumed its broad stability in Q2 of 2019, following its increase in Q1 of 2019 due to lower excess liquidity as a ratio to L/C deposits in M2.

Real monetary conditions remained tight

Real monetary conditions remained tight, backed by receding inflationary pressures as well as previous policy rate increases, notwithstanding the cumulative 300 bps policy rate cuts in Q1 of 2018 and Q1 of 2019.

Excess liquidity level remained relatively stable since April 2019, after increasing during February and March 2019 to record an average of EGP 737bn (13.9% of GDP) during June 2019.

Meanwhile, interbank activity remained relatively stable since April 2018, with interbank rates remaining below the policy rate by around 30 bps, as higher long-term absorption tenors offset the effect of higher short-term absorption of excess liquidity. Furthermore, the interbank yield curve remained relatively stable after shifting downwards, reflecting the 1% policy rate cut on 14 February 2019.

Yields for L/C government securities remained relatively stable since April 2019 to record 13.9% (net of tax) during Q2 of 2019 after declining from 15.8% on average in Q4 of 2018, reflecting c.2.0x the decline of the policy rate.

Meanwhile, the inverted yield curve has been broadly flattening between Q1 of 2018 and Q1 of 2019 before steepening in Q2 of 2019.

The flattening was partly driven by negative sentiment on EMs since May 2018, which led T-Bonds’ yields to rise more than that of T-Bills.

It was further supported by the larger drop in the accepted-to-required ratio of T-Bills vis-à-vis T-Bonds.

Meanwhile, the recent steepening in Q2 of 2019 was partly due to lower accepted-to-required ratio for T-Bonds while that of T-Bills remained relatively stable. Furthermore, the steepening was also supported by the shift in demand from T-Bills towards T-Bonds since Q4 of 2018, reflecting a positive shift in investors’ sentiments regarding Egypt’s macroeconomic performance.

Egyptian Eurobond yields have been broadly declining since the beginning of 2019 in line with the improvement in the risk premium for EMs, after increasing during most of 2018.

Moreover, Egypt’s (credit default swaps) CDS spreads remained relatively low compared to the majority of peers with similar sovereign credit rating. Furthermore, Egypt’s credit rating was upgraded by Moody’s and Fitch Ratings in April and March 2019, respectively, following the upgrade by S&P in May 2018.

In the banking sector, data until May 2019 show partial transmission of the 100-bp policy rate cut on 14 February 2019 to rates of new deposits. New deposit rates declined to record an average of 12.2%, reflecting a transmission in the magnitude of 0.6x the policy rate cut.

While rates of flexible deposits adjusted downwards, fixed-rate saving certificates more than or equal to three years remained broadly unchanged.

Meanwhile, rates of new loans remained relatively stable to record an average of 17.4% due to the weaker impact of loans at subsidised interest rates. As a result, interest rate margins widened to 5.2 percentage points, slightly above the longer-term average.

In equity markets, real prices partly recovered since the beginning of the year after declining in 2018 supported by the strong performance witnessed in Q1 of 2019 before losing momentum in Q2 of 2019.

Meanwhile, since the beginning of the year, the EGX30 USD index recovered by a cumulative 16% outpacing the MSCI EM index’s 6%, supported by the nominal exchange rate appreciation against the USD.

Meanwhile, data up to Q1 of 2019 show a decline in real unit prices in the secondary market before recovering somewhat in Q2 of 2019. Demand continued to shift from the secondary to the primary market, given more flexible payment plans offered by numerous developers.

Inflationary pressures remained contained and annual headline and core inflation declined to the lowest rates in more than three years.

Annual headline inflation declined to 9.4% in June 2019 from 14.1% and 13.0% in May and April 2019, respectively, thereby recording the lowest rate since March 2016.

Annual core inflation declined to 6.4% in June 2019 from 7.8% and 8.1% in May and April 2019, respectively, thereby recording the lowest rate since October 2015. Moreover, core inflation continued to record single digits for 12 consecutive months, averaging 8.3% during FY 2018/19.

Favourable base effects supported the decline of annual headline inflation in April and June 2019, while higher volatile food prices led to the increase of annual headline inflation in May 2019.

This comes after annual headline inflation was mostly affected by unfavourable base effects in Q1 of 2019. Favourable base effects were particularly evident in June 2019, as monthly inflation recorded negative 0.8% compared to positive 3.5% in June 2018, which included the impact of the implemented fiscal consolidation measures.

Non-food inflation had been hovering at around 13.1% since the beginning of the year, before dropping to 8.4% in June 2019, mainly driven by the favourable base effect that mainly affected the contribution of regulated followed by services items.

Meanwhile, food inflation averaged 14.2% since the beginning of the year, before dropping to 10.3% in June 2019, also supported by a favourable base effect.

Yet, food inflation has been relatively volatile, mainly due to the volatility of the contribution of fresh fruits and vegetables prices, while the contribution of core food prices has been declining since March 2019.

Yet, food inflation has been relatively volatile, mainly due to the volatility of the contribution of fresh fruits and vegetables prices, while the contribution of core food prices has been declining since March 2019.

With respect to key monthly developments, inflation in Q2 of 2019 was affected by seasonal factors such as Ramadan, Eid Al-Fitr and pilgrimage, which were mainly reflected in volatile food, clothing, and pilgrimage prices.

Furthermore, prices of citrus fruits registered in June 2019 its fifth consecutive increase, thereby recording a cumulative monthly increase by 71.6% to contribute by a cumulative of 26.1% of monthly headline inflation.

Moreover, prices of tomatoes declined in June 2019 after increasing for two consecutive months, while prices of potatoes declined for the third consecutive month.

In the meantime, prices of core food items declined in June 2019 after increasing in May 2019, mainly due to volatility of poultry prices. On the other hand, prices of rice as well as fish and seafood increased in June 2019 for the ninth and sixth consecutive month, respectively.

Average monthly core food inflation witnessed domestically since January 2019 was largely consistent with monthly international core food inflation, after diverging between August and December 2018 due to the slight increase in core food inflation domestically at the time of the domestic fiscal consolidation measures.

In June 2019, international core food inflation was mainly driven by lower prices of dairy products and poultry which was partly offset by higher prices of red meat.

The Outlook

After cutting the CBE’s key policy rates in its meeting on 14 February 2019, the Monetary Policy Committee (MPC) decided in subsequent meetings that prevailing policy rates are appropriate to achieve the inflation target of 9% (±3 percentage points) in Q4 of 2020 that was announced in December 2018.

Real GDP growth is expected to continue recovering, benefiting from continued structural reforms. Meanwhile, the primary fiscal balance is targeted to record a surplus of 2.0% of GDP in FY 2018/19 and to maintain this surplus in subsequent FYs to reduce debt levels, thereby yielding a 5.5 percentage points consolidation over the previous three years.

Accordingly, the inflation outlook continues to incorporate the recently implemented fiscal measures that included reaching cost recovery for most fuel products and fuel price indexation to underlying costs with quarterly revisions, as well as the increases in electricity prices. Meanwhile, the overall fiscal deficit is targeted to continue declining to record a preliminary 8.2% of GDP in FY 2018/9 and 7.2% of GDP in FY 2019/20, and to further decline thereafter.

The outlook for Brent crude oil price incorporated in the domestic inflation outlook remained unchanged compared to the previous monetary policy report, while spot prices remain subject to volatility due to potential supply-side factors as well as geopolitical risks. Meanwhile, international

food price forecasts relevant to Egypt’s consumption basket are expected to decline slightly during 2019 before increasing in 2020.

In addition to international commodity price developments, and particularly that of international oil prices which can pass through to domestic inflation via the quarterly price adjustments under the fuel price indexation mechanism, risks surrounding the domestic inflation outlook from the global economy continue to include trade tensions and economic growth developments.