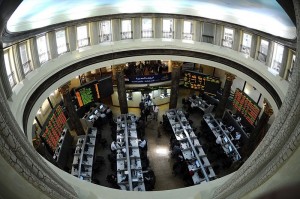

(Photo by Mohamed Omar)

Prosecution investigations revealed that a notorious conman, known as Al-Mestarayah, has only EGP 7m in six Egyptian banks, contrary to the EGP 300m that he has allegedly seized from depositors.

He had promised an 11% interest rate to depositors, but has ceased paying the profits since the start of 2015. Citizens who gave him the money through delegates raised lawsuits accusing him of defrauding them.

Ahmed Mostafa, also known as “Al-Mestarayah”, is 32 years old , was born in the Qena governorate, and has seized approximately EGP 300m from citizens in Upper Egypt, and alleged employing and investing this money in the fields of trading prepaid mobile phone cards and real estate investments.

Al-Mestarayah recruited 100 delegates to collect the money, in return for 20% of the collected money.

“I sold my farm to get rid of its problems and gave my money to Al-Mestarayah because I was told that I will get 11% profit every month, and then he stopped giving us our profit and he disappeared,” said one of the people who gave his money to Al-Mestarayah.

Experts attributed the spread of phenomena such as this one to the poor investment market in Egypt, as well as the weakness of the legislative structure, which does not seek to illegalise companies that exploit money or place controls on them. In addition to the weakness of the investment market are its lack of diversity and depth.

Meanwhile,Head of the Egyptian Financial Supervisory Authority (EFSA) Sharif Sami was of a different opinion, noting that in recent years, saving funds have spread in banks and also through investment funds, securities companies and portfolios management.

“Any investor or citizen can use these funds without putting their money in cheating and unknown companies,” added Sami. “The investment market in Egypt consists of 95 investment funds totalling EGP 60bn of shares that vary between funds, bonds and treasury bills.”

Sami noted that the market has balanced monetary funds, which include experts in these shares and bonds, in which people can buy and retrieve their shares and bonds through bank branches in different governorates in Egypt. Therefore there is no argument for those who believe that there are no savings funds in Egypt.

Moreover, there are 140 securities companies, and their financial volume in the first two months of 2015 was worth EGP 55bn, according to Sami.

Sami confirmed that there is a law managing the work of such companies, and at the same time we do not have any registered company in this regard.

Sami pointed out that banks’ or investments funds’ profit rates are higher than those in other countries, where they do not exceed 1%.

He said that the main reason for falling into the trap of conmen is the media, which does not work to raise awareness on the importance of investing in investment funds and banks, because there are no paid advertisements to play this role.

“It was important to raise awareness about various investment channels in Egypt to protect the depositors of swindlers, as the media does in raising awareness against certain dangerous diseases,” Sami said.

Meanwhile, Mohamed Deshnawy, an expert in financial markets and the CEO of Roots Securities Company, said that the Al-Mestarayah phenomenon emerged in accordance with several factors, such as the lack of an investment culture and the lack of legitimacy of direct investment alternatives, in addition to the low profit rates at banks or investment funds.

Deshnawy noted that the regulators are very weak, and the Ministry of Interior does not take action until after the crime happened, and the public funds department in interior ministry should take pre-emptive measures to ban such crimes.

“The most important role of the government is to disseminate the culture of investment in basic education stages, because this science is practiced by everyone in different cultures and qualifications,” added Deshnawy. “Upper Egypt requires great efforts to create actual investments and increase investment awareness through legal channels and encourage securities companies and investment banks to open branches in Upper Egypt to attract these funds.”

HC Securities company Deputy Chairman Mohamed Metwally said that there are problems in the capital market in Egypt. The first is the imposition of taxes on Egyptian stock market (EGX) profits while there is no balance in the tax treatment in other financial activities or funds, which causes speculators in the EGX to withdraw their money to invest elsewhere.

Metwally added that imposing a tax on financial documents (shares and bonds) owned by the investment banks, even if they are not sold, places a burden on the investment banks, noting that taxes should be imposed on sold documents, and not those owned by the investment bank.

He stressed that the complicated and difficult procedures of opening an account for trading on the EGX or in financial markets lead to the reluctance of the ordinary citizens to invest their money in these licenced channels.

“Swindlers find it easy to deal with these simple people without many complex procedures and papers,” added Metwally. “Swindlers are found all over the world, not only in Egypt, and there are some laws and regulations regulating the money market in Egypt, but in many cases they may not overcome the entities that operate in an unlicensed and illegal manner.”

Metwally demanded that the government open up purchasing bonds and treasury bills from the state to the public. For example, if the Ministry of Finance gives citizens the right to buy bonds and treasury bills instead, major banks can help citizens put their money in right and legal places.

CEO of the Holding Company for Spinning and Weaving Ahmed Mustafa said that media has a major role in educating people on the importance of depositing money into investment banks and commercial banks, which will invest these money in national projects that will benefit the community.

Mustafa added the monetary policy in Egypt has to be reconsidered, and the government should provide more incentives for citizens and develop provident funds.

Mustafa noted that the investment funds and banks focus on the conscious urban classes, and neglect Upper Egypt and ordinary people, despite the fact that they have huge population that greatly outnumber the citizens in the cities.

“The state can adopt national projects that open to citizens the opportunity to invest in them, as in the new Suez Canal project, which could also work in the Cairo Capital project (CC), which would benefit both the investors of citizens and the national economy,” said Mustafa.

Further, the banking analyst said there were shortcomings in the performance of the investment banks, like sluggishness in the process of creating products that attract investment, as well as legal bureaucracy which restricts and slows down the process of managing the products offered by investment funds.

He added that the investment banks have to create and innovate new means and tools of investment in line with a certain segment of people, and also meet their investment needs. He further called for establishing a law that protects very small investors from falling into the trap of swindlers, attracting their money under the guise of higher benefits.