Real estate investment and management firm Jones Lang LaSalle (JLL) said in its latest report on Egypt that the market exhibited positive performance during the third quarter (Q3) of 2015, despite devaluation of the Egyptian pound.

The report said the retail and hospitality sectors continued to perform slowly but have shown steady growth in the same quarter. The completion of the New Suez Canal extension was seen by JLL as creating development opportunities in the sector.

Daily News Egypt interviewed JLL Egypt Director Ayman Sami to discuss his outlook for 2016 as well as the challenges and opportunities in the real estate sector.

What are your expectations for the real estate sector in 2016?

What are your expectations for the real estate sector in 2016?

We are quite optimistic with regards to the real estate sector in general in 2016.

We cannot say that all activities will perform the same way. We are currently monitoring the residential, offices, retail, and hotels markets.

From your viewpoint, what are the major challenges the sector is facing?

Hotels have been the hardest hit asset class due to the reduced level of tourism, affecting both room rates and occupancy. However we are expecting this to improve as stability returns to the country slowly.

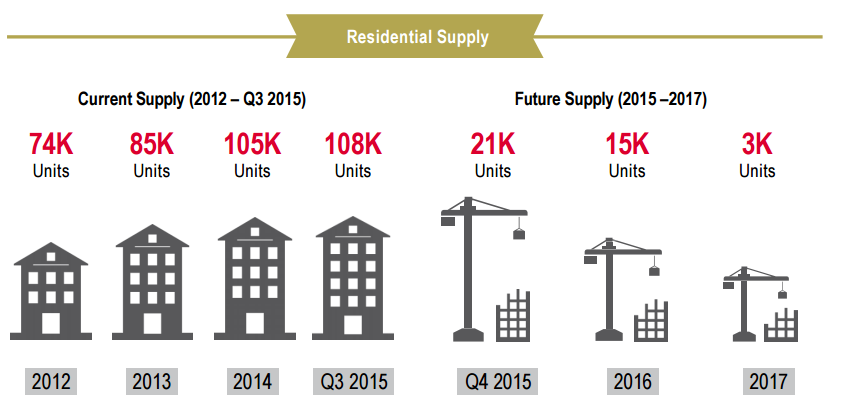

Residential real estate continues to act as a hedge against devaluation of the currency and is considered as a safe haven for investment. Demand continues to be strong here, driven by the large number of marriages and the high population growth. Although prices have soared to unprecedented levels, both developers and government are working on solutions to make the housing units more affordable.

One approach was the Private Public Partnership, which is a method whereby both the public and private sector share the development risk and profits. This is a good method to prevent speculation over the land prices. Developers are also working on resising the units or extending payment terms to make the units more affordable.

How are the government’s mega real estate projects, such as the Cairo Administrative Capital and Arabtec’s 1m housing units projects, influencing the sector?

The new administrative capital, in my view, is the natural extension of the city and it will develop anyways at least partially and the evidence is that major developers have already started to develop future city and parcels on the edge of New Cairo.

With regards to affordable housing and Arabtec, this is not only a challenge in Egypt, but everywhere worldwide. Affordable housing requires many aspects to make it successful and it has many inputs including the price of land, construction cost, infrastructure, etc.

In the end, the developer needs to deliver large volumes, ensure that they are sold, and should be able to generate some profit. Margins need to be thin to make the units as affordable as possible. Hence the whole mix of inputs and the selling of the project needs to occur in a very efficient manner.

How do you view the current real estate prices in Egypt? How is the dollar crisis affecting the sector?

How do you view the current real estate prices in Egypt? How is the dollar crisis affecting the sector?

We believe real estate prices will continue to increase as long as the pound is devaluing and Egypt remains at the same levels of inflation. However we are currently witnessing a slowdown in the secondary market, since they are competing against developers who have extended their payment terms further, some beyond six years.

From your viewpoint, are new regulations required to boost the sector?

With regards to regulations, I believe the land use needs to be analysed first and allocated as per the demand requirements. This will avoid market cannibalisation, which has been especially evident amongst retail developments.