Reuters

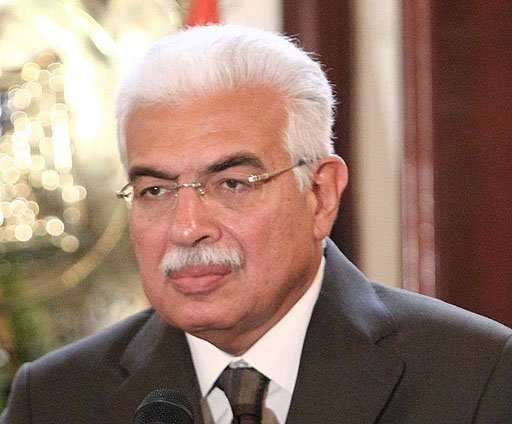

NEW YORK: Egypt s economy is expected to grow by 7 percent in the next five years and to break last year s record for investment from abroad, Investment Minister Mahmoud Mohieldin told Reuters on Monday.

Egypt s economic reform program is already paying dividends, with an expected 7 percent growth for the fiscal year that ends June 30. In the first half of this fiscal year growth was at 7.2 percent compared with the same period the previous year.

Foreign direct investment (FDI) was also expected to rise to $8 billion, a record level, driven principally by investment from the United States.

This year we are expecting $7.5 billion to $8 billion, more than last year which was considered a record year (with FDI reaching $6 billion), Mohieldin said.

Following a cabinet reshuffle in 2004, Egypt has undergone privatization reforms that have allowed real gross domestic product growth to accelerate to 6.9 percent in 2005/06 from 4.2 percent in 2003/04, marking the third consecutive year that GDP growth has increased.

The ministry is offering investment opportunities in several sectors – including banks, container handling companies, tourism, manufacturing and petrochemicals – and Mohieldin was in New York to promote these opportunities.

Mohieldin also said the privatization of the remaining 20 percent of Bank of Alexandria was still up for grabs. Last year most of the bank was sold to Italy s Intesa San Paolo for $1.6 billion.

Proceeds of the privatization spree have gone to pay public enterprises non-performing loans from commercial banks, and to restructure some of the public companies and make them solvent before sale, the minister said. Proceeds have also gone to the budget, he added.

When we started we had LE 31 billion of non performing loans, today we have less than 10 billion. Within two years we managed to solve the problem that was hanging over us for two-and-half decades. These loans originated in the 1970s, Mohieldin said.

The main challenge however, remains the tight fiscal position. The budget is pressured by high levels of subsidies and public-sector wages that account for more than 55 percent of government expenditures, as well as debt servicing which accounts for 18 percent of expenditures.

According to Mohieldin, the government caps current spending by targeting the deficit by one-percentage point per year from 9 percent of GDP. Tax income now accounts for 29.3 percent of government revenue, doubling from 12.8 percent in fiscal year 2005, and Mohieldin said the number of taxpayers has also doubled to 2 million.

But unless the politically sensitive issue of subsidies and the public-sector wage bill are rationalized, Egypt s public-sector indebtedness will continue to mount, analysts at Bear Stearns bank said in a research note.

In addition, the general Egyptian has not seen the benefits of the past two years of economic growth, but instead has experienced rising inflation.

We expect a trickle down effect but two years is not enough in any country after almost seven years of slow growth. We need to grow by 6.5 percent to 7 percent in the next five years, Mohieldin said.

But we cannot benefit from growth unless there is good stability in terms of prices, he added.

The minister said inflation had risen since last year due to revisions in fuel prices and price increases of food products as a result of avian flu.

These are two supply-side changes that hopefully are not going to be repeated, Mohieldin said.