AUR Leasing, a subsidiary of AUR Capital, plans to issue securitised bonds worth EGP 1.7bn next month.

According to Daily News Egypt, the company is preparing the issuance file to apply to the Financial Regulatory Authority and expects to issue the bonds in the second half of next month.

The company aims to use the proceeds of the issuance to diversify its financing operations and repay some of its debts to banks.

AUR Capital acts as the financial advisor and issuance coordinator, while El Dreny and Partners serve as the legal advisor for the issuance.

Meanwhile, AUR Consumer Finance is expected to complete the issuance of securitised bonds worth EGP 300m this week.

Securitisation activity has been performing strongly for two consecutive years, with the expansion of consumer finance companies and the return of the New Urban Communities Authority to the market with its large-sized issuances.

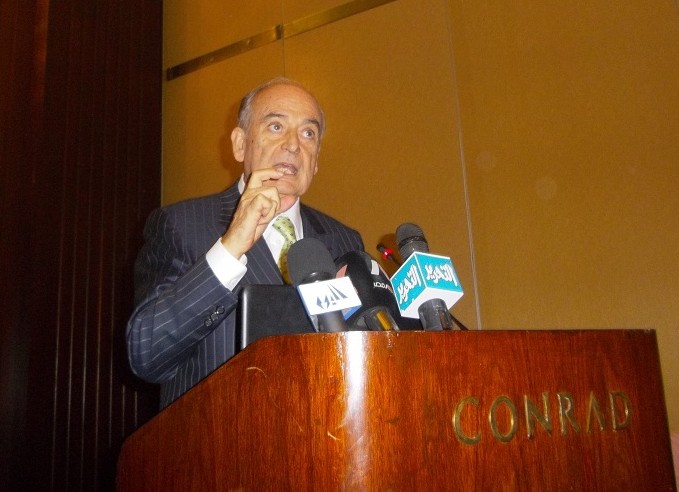

Mohammed Farid, Chairperson of the Financial Regulatory Authority, said that there is an increasing interest from various economic entities in the financing formats provided by non-banking financial activities. He added that these activities offer financial solutions that suit the needs of companies for growth and expansion, as well as for investment and savings. He stressed the need for continuous improvement and development of the procedures for issuing these instruments, as they play a vital role in financing companies, entities, and public legal persons.